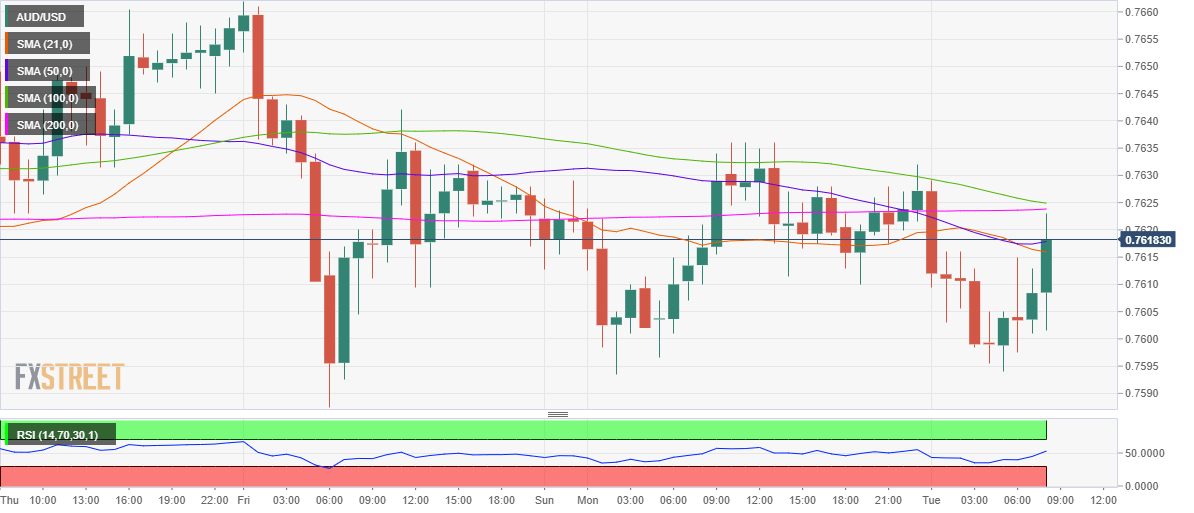

- AUD/USD reverses a dip below 0.7600, as the US dollar pullback fizzles.

- The aussie looks to extend the bounce above 50-HMA as RSI turns bullish.

- Impending bear cross remains a cause for concerns ahead of the US CPI.

AUD/USD has erased most of its early losses, as the bulls look to extend the recovery towards the 0.7650 barrier.

In doing so, the spot faces immediate resistance at the horizontal 50-hourly moving average (HMA) at 0.7618, where it now wavers.

The Relative Strength Index (RSI) has pierced through the midline from below, suggesting a shift in the sentiment towards the bullish traders.

However, the recovery attempt by the aussie could be likely threatened should impending bear cross on the hourly sticks materialize.

The 100-HMA is on the verge of breaching the horizontal 200-HMA from above, which would confirm a bearish crossover.

Until the above formation is validated, the price could extend towards the 200-HMA at 0.7332 if the buying interest accelerates.

AUD/USD: Hourly chart

Alternatively, the sellers could once again challenge the daily lows of 0.7595, below which the April 9 low at 0.7587 could be tested.

The April 1 low at 0.7531 could further protect the downside if the bulls throw in the towel.

AUD/USD: Additional levels