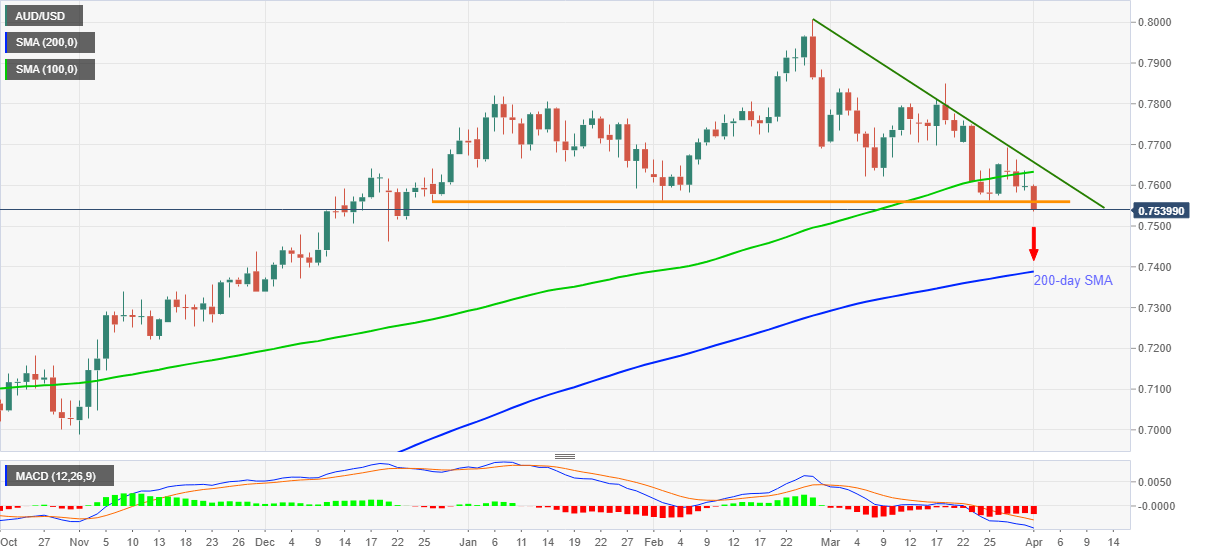

- AUD/USD extends losses below three-month-old horizontal support to test December 23, 2020 levels.

- Today’s close will be pivotal as MACD favors bears targeting 200-day SMA.

- Bulls will have to cross 100-day SMA, five-week-old resistance line to retake controls.

AUD/USD takes offers around the lowest since late December 2020 while flashing 0.7539, down 0.77% intraday, ahead of Thursday’s European session. The aussie pair’s latest losses could be traced to the downside break of a horizontal area comprising multiple lows marked in the last three months.

Given the MACD also flashing bearish signals, not to forget the pair’s sustained trading below 100-day SMA and a downward sloping trend line from February 28, AUD/USD bears are hopeful to meet the 200-day SMA level of 0.7388.

Though, a daily closing below 0.7557 becomes necessary for the bears to cheer the latest breakdown.

Meanwhile, recovery moves below 100-day SMA and the short-term resistance line, respectively around 0.7635 and 0.7665, seem less important.

Overall, AUD/USD seems ready for a notable south-run after a stellar run-up during late 2020.

AUD/USD daily chart

Trend: Further downside expected