- AUD/USD bulls step in at daily support and target upside correction.

- Bears will be seeking a test of familiar structure for a discount.

AUD/USD is correcting the string downside move as we head into early Asia.

The US dollar has been the top performer on Tuesday in risk-off markets which has weighed don the commodity complex.

The following top-down analysis illustrates that the price is headed towards a sizeable retracement.

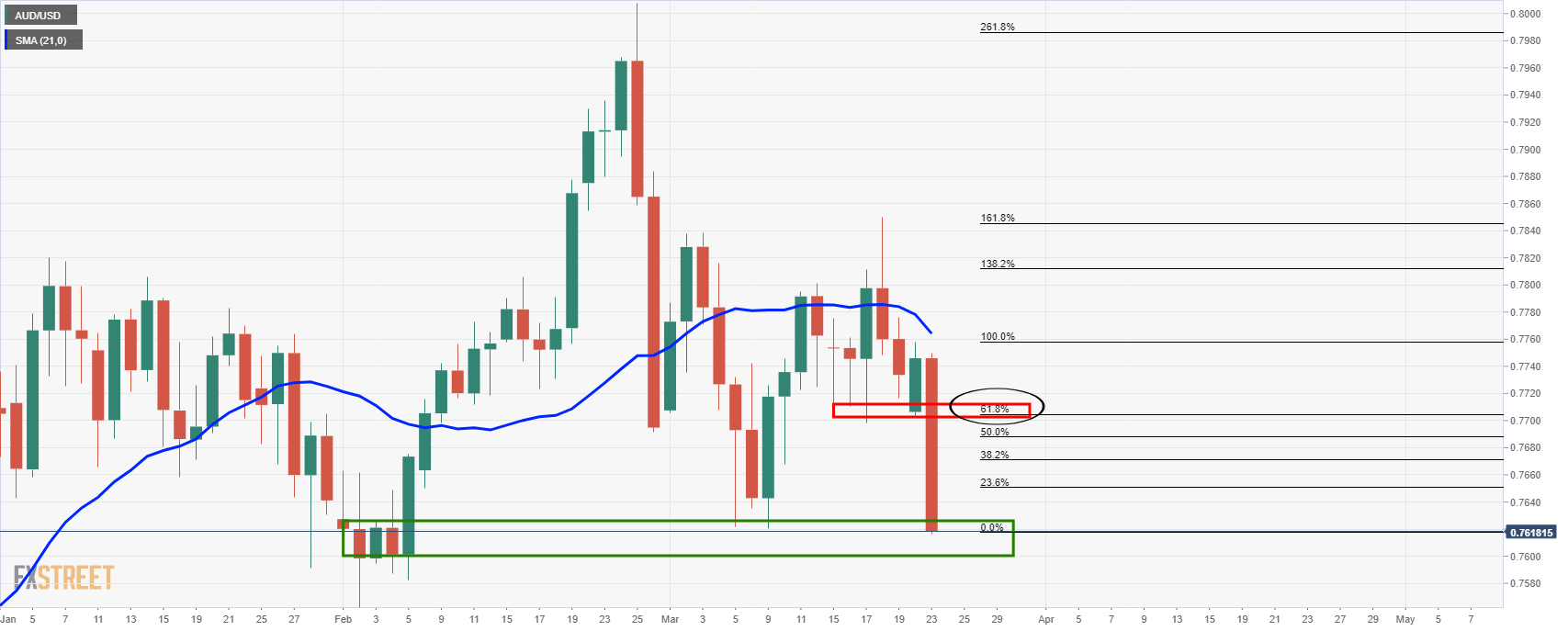

Daily chart

The bulls can seek a string retracement to old support and a confluence of the 61.8% Fibonacci retracement.

However, there are nearer-term targets on the lower time frames.

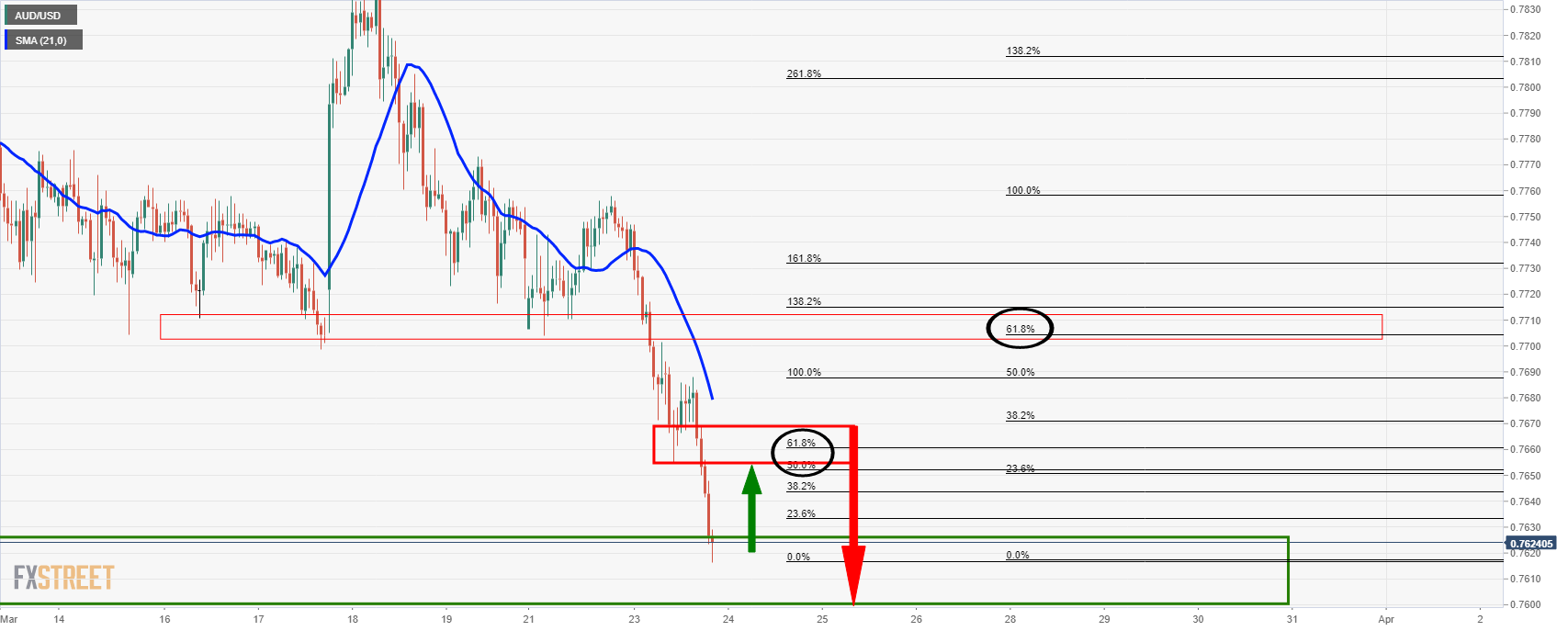

Hourly chart

There is a confluence of old support meeting critical Fibonacci levels on the hourly chart.

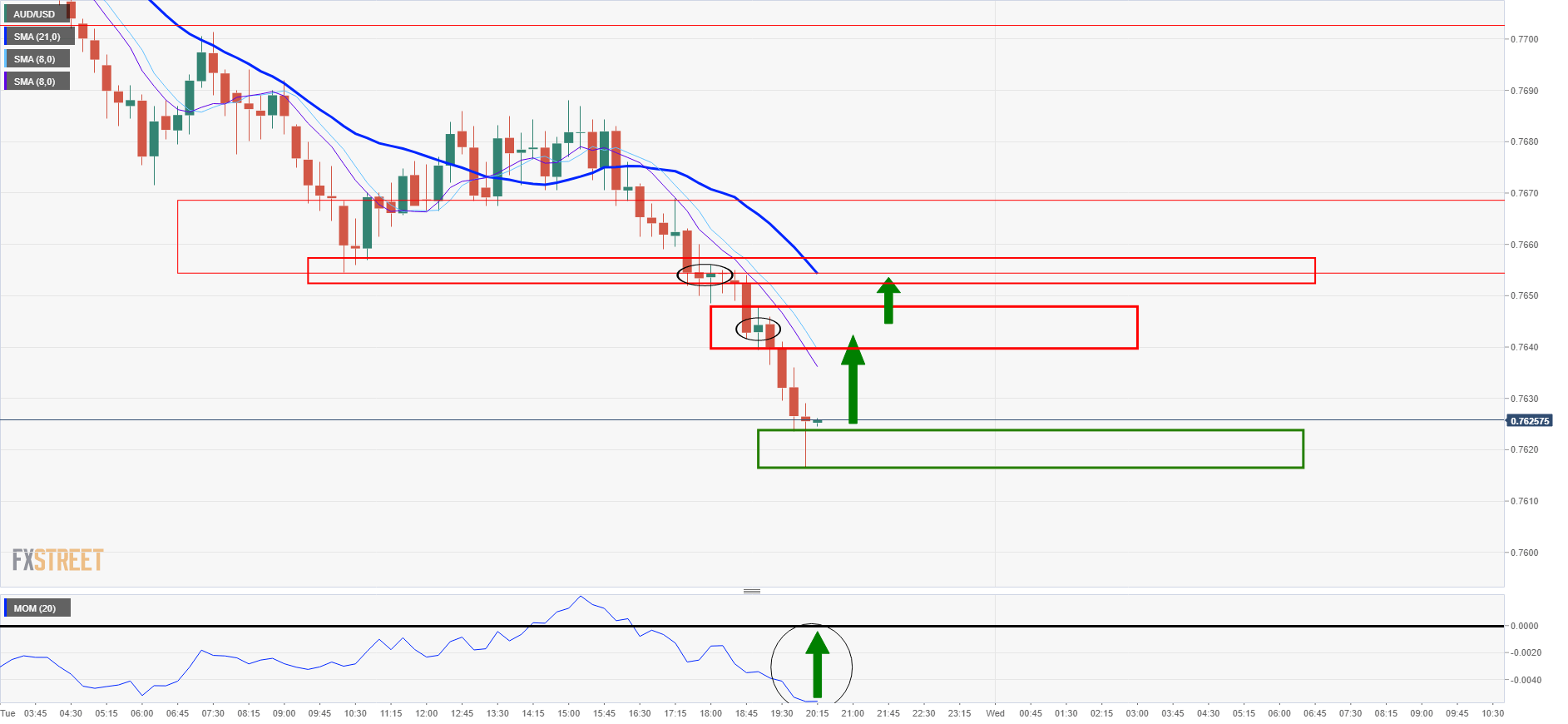

15-min chart

The lower time frames, such as the 15-min chart, can be used to identify near term structure in order to seek out optimal entry and targets.

In this case, the conditions remain bearish but a cross over of the 8 open and 8 close SMAs can help reinforce the bullish bias as Momentum moves towards more positive territory.