- AUD/USD price remains positive, just below the 0.7500 mark.

- FOMC’s tapering start in November may provide room for the Greenback to resurge.

- Australia’s bond mark gains while RBA is cautious about hiking rates before 2024 amid rising energy prices and slow economic recovery.

The AUD/USD price analysis suggests a technically bullish picture amid better risk mode, but dovish RBA may dampen the rally.

-If you are interested in forex demo accounts, check our detailed guide-

The Australian dollar soared against the US dollar overnight as Wall Street traders returned to risk. After closing with a gain of 0.54%, the Dow Jones Industrial Average (DJIA) ended the day. The positive earnings reports prompted market participants to shift towards risky assets. In addition, the Netflix third-quarter results were impressive after the New York close.

According to Federal Reserve System Governor Christopher Waller, the next FOMC announcement should bring about a cut in the purchase of assets. However, Waller downplayed the risk of inflation as he was optimistic about employment. The next FOMC meeting will take place on 2-3 November. As a result, the yields on long-term government bonds rose, while short-term 2-year and 5-year bonds fell.

On the other hand, the RBA expects Australia’s economy to resume growth in the December quarter, though it will not return to its delta trajectory until the second half of 2022. As a result, there is no expectation that economic conditions will improve by 2024 to allow the bank to raise interest rates.

The rise in energy prices is driving up inflation expectations and contributing to an appreciation of the yield curve worldwide. Locally, one of the critical components of the RBA’s monetary policy has been called into question due to the release of uncomfortably high inflation rates in New Zealand on Monday.

At 0.2%, it was nearly double the 0.1% target of the Reserve Bank of Australia for April 2024. On Friday, the yield on the 3-year bond of November 2024 was 55 basis points. Yesterday, it was 85 basis points. Hence, the market moved at a price due to an interest rate hike as early as May 2022 and a 100 basis point accumulated interest rate hike by the end of 2023.

In yesterday’s bond market challenge, the Reserve Bank of Australia announced a 25-basis point increase in the cost of debt between April 2023 and April 2024, reaching up to 100 basis points. In London trading, bond yields for April 2024 fell to around 0.125 percent.

Today, the RBA announced it would purchase AU $ 800 million in semi-public securities between July 2024 and November 2032 to support that initiative. These measures together somewhat dampened the recent AUDUSD rally.

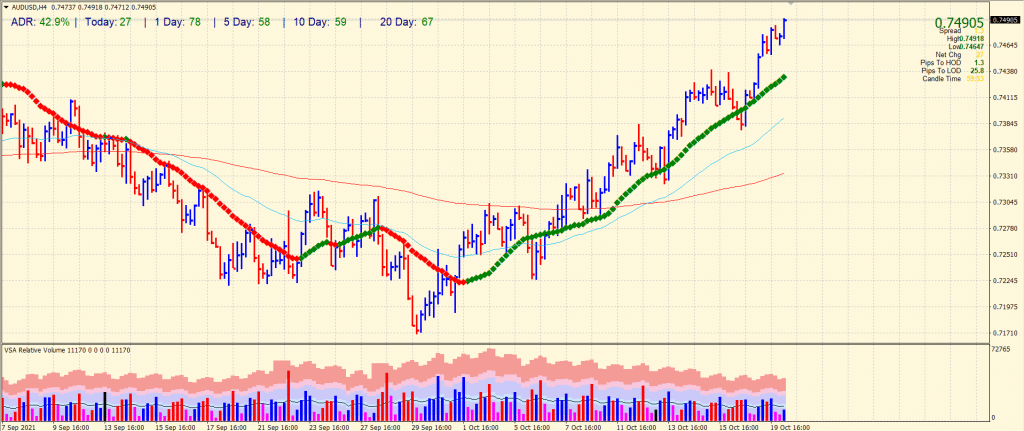

AUD/USD price technical analysis: Bullish action looking to break 0.7500

The AUD/USD price is playing around the daily highs just below the 0.7500 level. The price is comfortably bullish above the key moving averages on the 4-hour chart. The bulls may attempt to break the 0.7500 level ahead of 0.7530. On the flip side, horizontal level and 20-period SMA confluence around 0.7440 may support ahead of 0.7400.

-If you are interested in Islamic forex brokers, check our detailed guide-

The volume data is still positive for the bulls and may provide extra room for the gains. However, the average daily range is at 38%, which indicates the low volatility on the day. Just keep in mind that today is Wednesday, and there can be a mid-week reversal to occur in the London session.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.