- In advance of the Australian unemployment data, the AUD/USD pair corrected from 0.7500.

- Inflation in the US is not a concern for investors, and interest rates are only modestly rising.

- Australia has an unemployment rate of 3.9%. So, the coming jobs data holds significance for the pair.

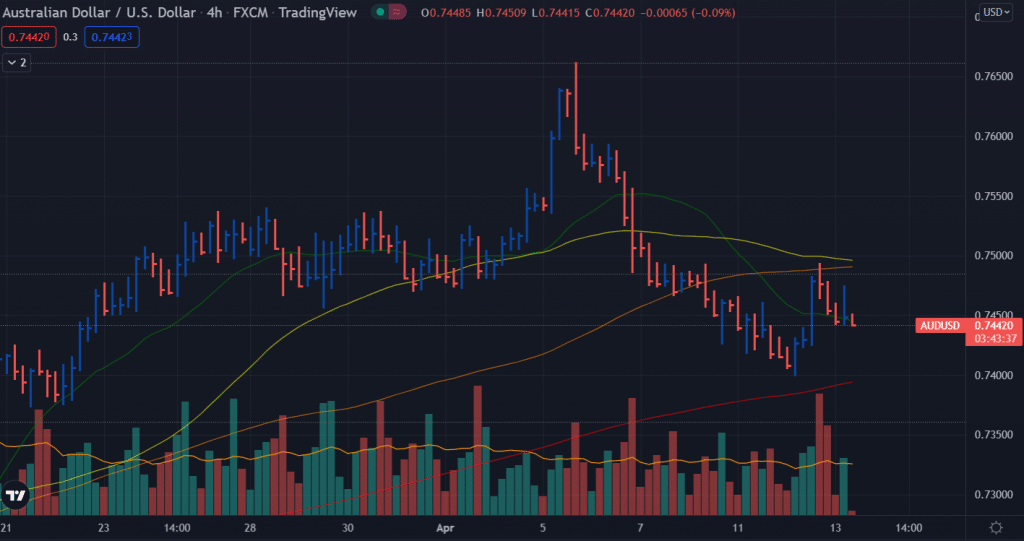

The AUD/USD price analysis shows a bearish picture as the pair pulled back slightly around 0.7500 following a decent bullish reversal from Tuesday’s 0.7400 low. On Tuesday, US inflation data led major currencies to higher. However, several antipodes were caused by the consumer price index (CPI) release of 8.5% in the US.

–Are you interested in learning more about CFD brokers? Check our detailed guide-

US CPI

A significant rate hike in May’s monetary policy is likely based on several years of high inflation and higher labor force participation. In addition, the US economy is hurting from high prices on staple foods, as evidenced by hot US CPI numbers excluding food and energy. According to the report, excluding food and energy, US inflation came in at 6.5%, in line with market expectations and the previous reading.

RBA’s stance

Following the Reserve Bank of Australia’s (RBA) decision to keep interest rates on hold, the asset fell sharply from its previous high of 0.7662 last week. According to an analysis of the Reserve Bank of Australia’s monetary policy, the government is not currently experiencing constructive price pressures that would increase interest rates.

Chinese data

A trade surplus of 738.8 billion yuan fell to 300.58 billion in February. In addition, Australia is the world’s largest exporter to China, and its main concern is a decline of 1.7% in Chinese imports, while the Strait expects a positive increase of 11.4%.

What’s next to watch for AUD/USD price analysis?

Investors will be looking for further direction from Thursday’s release of the Australian unemployment rate. According to a preliminary estimate, the unemployment rate in Australia has dropped from 4% to 3.9%.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

AUD/USD price technical analysis: Key SMAs reject bulls

The AUD/USD price could not hold onto gains and surrendered the upside at the congestion of 50 and 100 SMAs on the 4-hour chart. Moreover, we see an upthrust bar as well. Although the 20 SMA has been supported temporarily, we may see a deeper correction below the level.

The volume data shows a bearish bias on the 4-hour chart. On the other hand, the volume for the down wave is rising.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money