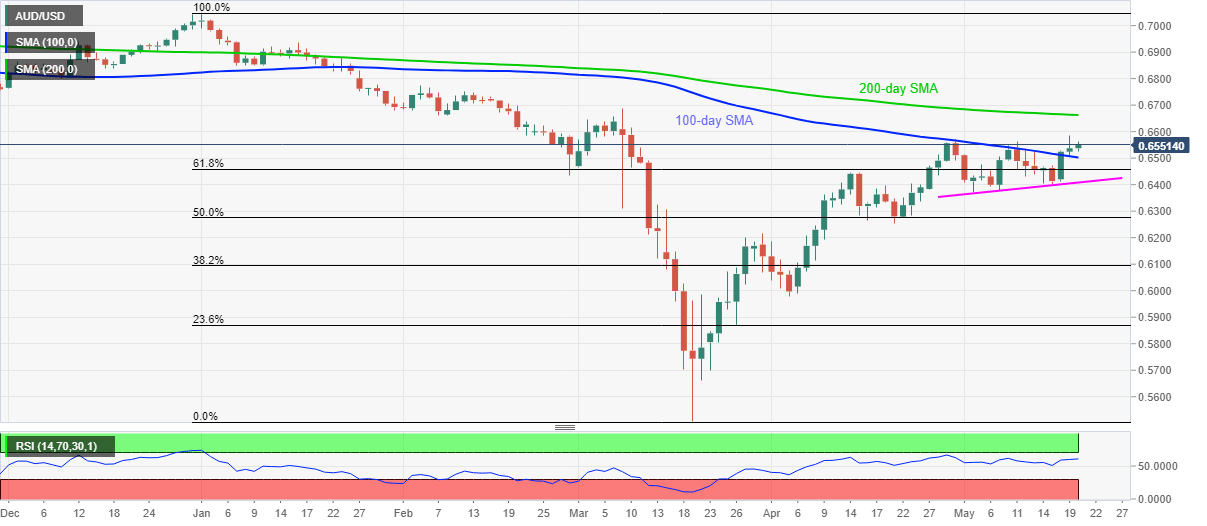

- AUD/USD stays mildly bid around the highest in 10 weeks.

- Failures to pick the bids above 100-day SMA indicates pullback.

- 200-day SMA, March high lure buyers during further upside.

AUD/USD fades upside momentum while taking rounds to 0.6550, up 0.18% on a day, during the pre-European session on Wednesday.

That said, a sustained break above the key Fibonacci retracements of December 2019 to March 2020 fall and 100-day SMA keeps buyers hopeful.

As a result, bulls can aim for a 200-day SMA level of 0.6663 and March month top near 0.6685 during the further upside.

However, a daily closing below 100-day SMA level of 0.6500 will quickly fetch the quote towards 61.8% of Fibonacci retracement close to 0.6460/55.

In a case where the pair keeps declining below 0.6455, an upward sloping trend line from May 04, currently at 0.6408, will be on the bears’ radars.

AUD/USD daily chart

Trend: Bullish