- AUD/USD seemed struggling to capitalize on its modest intraday gains.

- A pickup USD demand was seen as a key factor that capped the upside.

- The near-term set-up remains tilted firmly in favour of bearish traders.

The AUD/USD pair held on to its modest daily gains through the early North American session, albeit lacked any follow-through and remained confined in a range above the 0.7600 mark.

The US dollar remained well supported by some follow-through uptick in the US Treasury bond yields and better-than-expected ADP report on the US private-sector employment. This, in turn, was seen as one of the key factors that kept a lid on any meaningful gains for the AUD/USD pair.

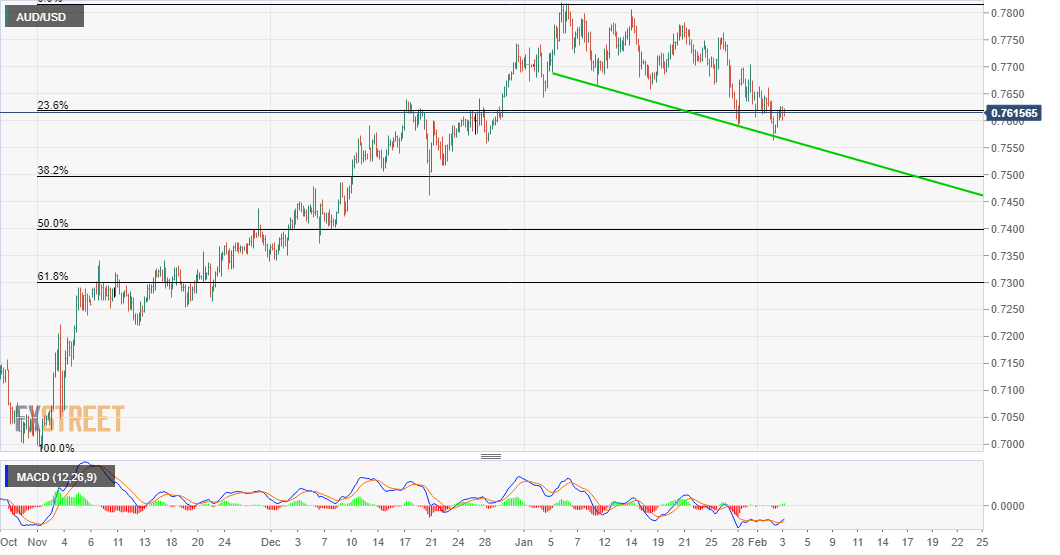

Currently hovering around the 23.6% Fibonacci level of the 0.6990-0.7820 strong move up, the pair is having difficulty in attracting investors. The inability to gain any meaningful traction suggests that the recent corrective slide from multi-year tops might still be far from being over.

The bearish outlook is further reinforced by the fact that technical indicators on the daily chart have just started drifting into the negative territory. Hence, any further move up might still be seen as an opportunity for bearish traders and runs the risk of fizzling out rather quickly.

A sustained weakness below the overnight swing lows, which coincides with a short-term descending trend-line support, currently around the 0.7565-60 region, will reaffirm the bearish bias. The AUD/USD pair might then accelerate the slide further towards the key 0.7500 psychological mark.

The latter represents 38.2% Fibo. level, which if broken decisively should pave the way for a further near-term depreciating move.

AUD/USD 4-hourly chart

Technical levels to watch