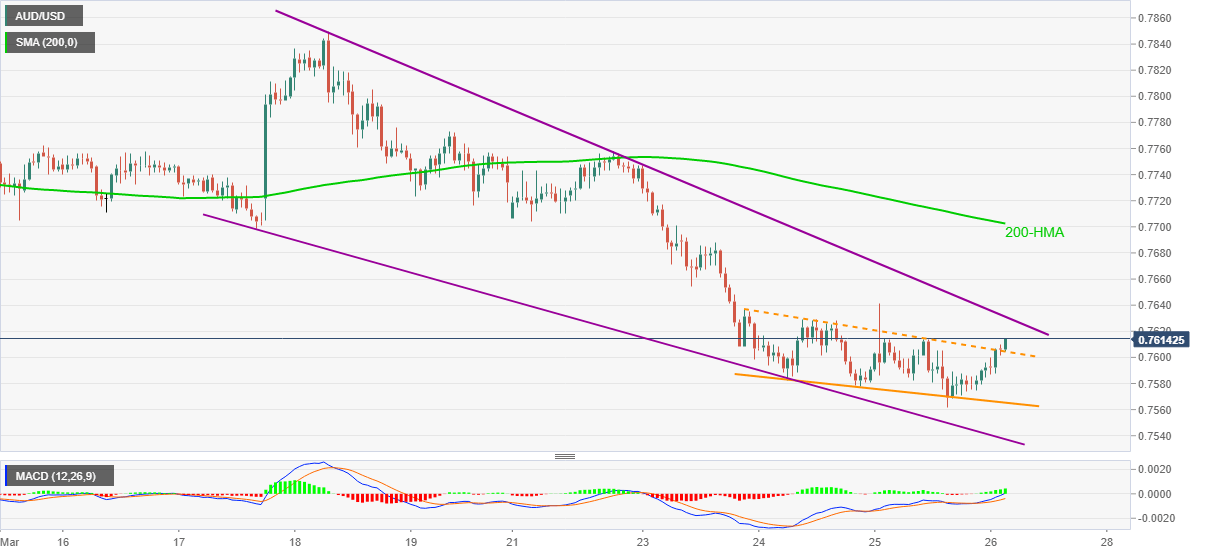

- AUD/USD crosses falling trend line from Tuesday but needs confirmation of a bullish chart pattern.

- 200-HMA adds to the upside filters, bullish MACD and trend line breakout favor short-term buyers.

AUD/USD takes bids near 0.7610, up 0.40% intraday, during early Friday. In doing so, the aussie pair snaps a three-day losing streak while crossing the immediate resistance line.

Although bullish MACD and break of the short-term hurdle favor intraday bulls, the upper line of the one-week-old falling wedge bullish formation needs a breakout for the further rise of AUD/USD.

While a clear break of 0.7635 should theoretically aim for the monthly top of 0.7850, a 200-HMA level of 0.7705 can offer an intermediate halt during the rally.

Alternatively, pullback moves below the resistance-turned-support, at 0.7600, can re-test a three-day-long descending support line 0.7565.

However, the quote’s further weakness past-0.7565 will be tested by the stated wedge’s lower line around 0.7535.

To sum up, AUD/USD portrayed corrective pullback amid risk-on mood but needs validation before recalling the buyers.

AUD/USD hourly chart

Trend: Further recovery expected