- AUD/USD witnessed some short-covering bounce on Thursday amid a softer USD.

- The set-up favours bearish traders and supports prospects for further weakness.

- Any further move up might be seen as a selling opportunity and remain capped.

The AUD/USD pair climbed to fresh session tops, around the 0.7615 region in the last hour and has now eroded a major part of the overnight losses to the lowest level since early February.

A modest uptick in the US equity futures underpinned the safe-haven US dollar, which, in turn, extended some support to the perceived riskier aussie. That said, worries about the third wave of COVID-19 infections in Europe could act as a headwind for the AUD/USD pair and cap any meaningful upside.

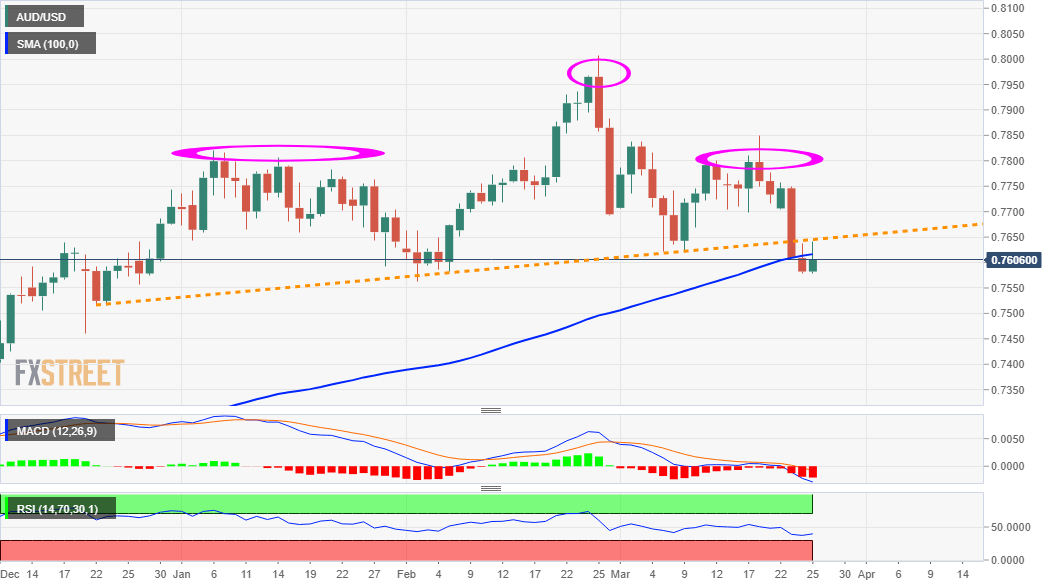

From a technical perspective, the overnight fall confirmed a fresh bearish breakdown through a head and shoulders neckline support. However, slightly oversold conditions on hourly charts held traders from placing fresh bearish bets, rather prompted some short-covering move around the AUD/USD pair.

Meanwhile, technical indicators on the daily chart have been gaining negative momentum and are still far from being in the oversold zone. Hence, any further recovery might still be seen as a selling opportunity and remain capped near the mentioned support breakpoint, around the 0.7665 region.

On the flip side, the 0.7580-75 region now seems to have emerged as immediate support. This is closely followed by YTD lows, around the 0.7565-60 region, which if broken decisively will reaffirm the negative outlook and set the stage for an extension of a one-month-old downward trajectory.

The AUD/USD pair might then turn vulnerable and accelerate the fall towards challenging the key 0.7500 psychological mark. The bearish trend could further get extended and drag the major towards the next relevant support near the 0.7460 area.

AUD/USD daily chart

Technical levels to watch