- AUD/USD fails to keep the previous day’s upside momentum.

- 100-HMA, one-week-old rising trend line offers immediate support.

- Bulls need to refresh monthly high to retake the controls.

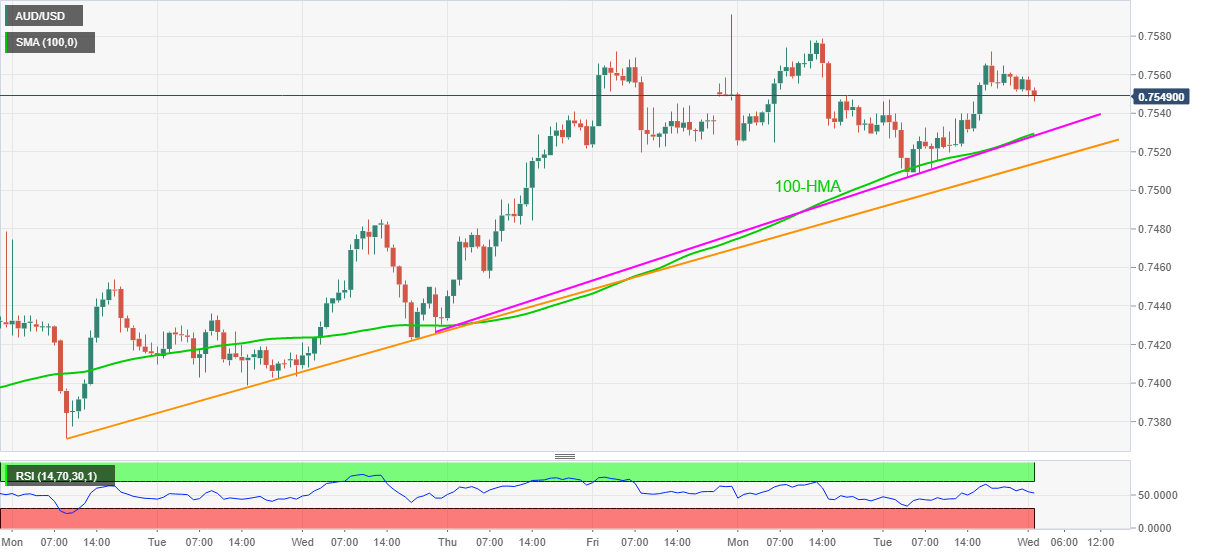

AUD/USD drops to the intraday low of 0.7545, currently at 0.7548, while marking a 0.16% decline on a day during early Wednesday. The aussie pair benefited from upbeat market sentiment the previous day but the recent cautious mood ahead of the key US stimulus announcements and Fed decision, coupled with the Aussie-China tussle, weigh on the quote.

However, a joint of 100-HMA and an ascending trend line from December 09, around 0.7530, will restrict the pair’s immediate downside.

Also acting as the key support is an upward sloping trend line from December 07, at 0.7513 now, as well as the 0.7500 round-figure.

If at all the risks remain heavy and weigh the quote past-0.7500, December 09 top near 0.7485 can lure the AUD/USD sellers.

On the contrary, recent tops near 0.7580 can offer nearby resistance to the quote ahead of directing AUD/USD bulls toward the 0.7600 threshold. Though, any further upside will not refrain from challenging June 2018 peak near 0.7680.

AUD/USD hourly chart

Trend: Pullback expected