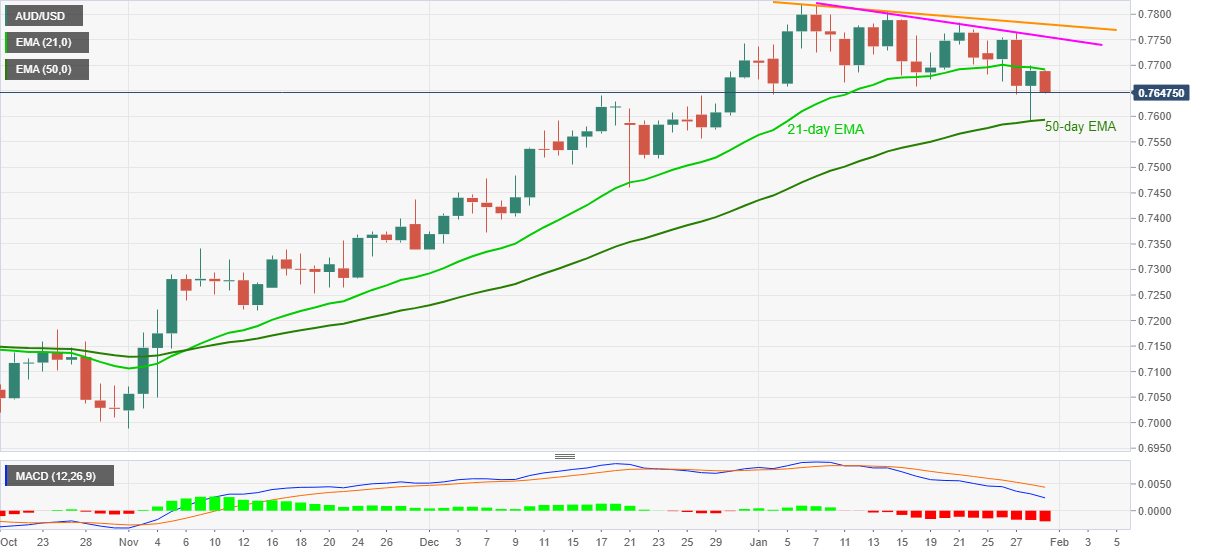

- AUD/USD stays heavy around mid-0.7600s, stands on a slippery ground off-late.

- Bearish MACD, notable pullback from 21-day EMA favor sellers.

- Bulls have multiple trend lines as additional barriers to entry.

AUD/USD stays pressured around 0.7645, down 0.50% intraday, during early Friday. The pair dropped to the lowest in a month the previous day before bouncing off 50-day EMA. However, failure to cross 21-day EMA seems to back the latest weakness amid bearish MACD.

With the failures to cross short-term EMA, needless to mention about resistance lines from early January, AUD/USD sellers keep their eyes on the 50-day EMA, around 0.7590. During the fall, a horizontal area comprising lows marked since December 17, near 0.7645/40, can offer an intermediate halt.

In a case where the AUD/USD bears dominate past-0.7590, the 0.7500 round-figure and December’s low near 0.7460 will be on their radars.

Meanwhile, an upside clearance of 21-day EMA level of 0.7695 will have to cross the 0.7700 threshold before attacking a descending resistance line from January 07, at 0.7755 now.

Should the bullish impulse cross the 0.7755 trend line, another one from January 06, near 0.7780 will lure the AUD/USD buyers.

Overall, AUD/USD is up for correction but the broad bullish trend isn’t faded yet.

AUD/USD daily chart

Trend: Pullback expected