- AUD/USD falls for the second straight day on Monday.

- An impending bear cross on the daily chart keeps the bears hopeful.

- RSI looks south below the midline, with more downside in the offing.

AUD/USD is back in the red zone starting out a fresh week on Monday, having faded Friday’s rebound to near 0.7625 region.

The sentiment around the aussie remains sour amid a broad-based US dollar recovery. The downbeat market mood and Fed Chair Powell’s encouraging comments seem to bode well for the greenback.

Meanwhile, covid vaccine delays in Australia also weigh on the aussie dollar. Australia’s New South Wales (NSW) Premier Gladys Berejiklian noted that he fears Australia will be left behind as the rest of the world opens.

From a near-term technical perspective, the bears have regained control, as AUD/USD now looks to retest Friday’s low of 0.7588.

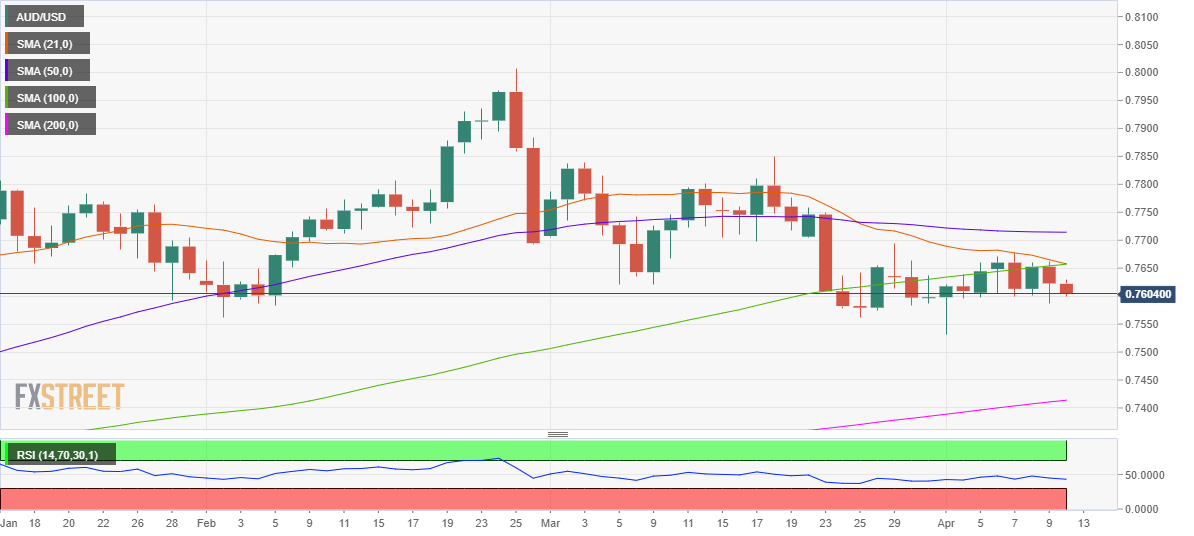

An impending bear cross on the daily chart, represented by the 21-daily moving average (DMA) on the verge of piercing the 100-DMA from above, points to more losses in the offing.

Adding credence to further downside, the 14-day Relative Strength Index (RSI) edges lower while below the midline, currently at 43.10.

A sustained break below Friday’s low could expose the April 1 low of 0.7531. Further south, the 0.7500 round figure could be put to test.

AUD/USD: Daily chart

On the flip side, any recovery attempts could face stiff resistance around 0.7657, the confluence of the 21 and 100-DMAs.

The next stop for the AUD bulls is seen at the April 7 high of 0.7678, as a test of the 0.7700 mark remains inevitable.

AUD/USD: Additional levels