- Australia’s retail sales went up, showing strong demand.

- Consumer confidence in Australia dropped to 0, below the long-term average.

- Australia’s demand remains high due to record-low unemployment.

Today’s AUD/USD price analysis is bullish. October was another excellent month for sales and profitability for Australian businesses, but rising prices and a drop in forward orders hurt confidence and may foreshadow a future slump. Retail sales increased to 0.4% from the previous 0.0%.

–Are you interested in learning more about CFD brokers? Check our detailed guide-

“Consumers continue to spend despite headwinds from inflation and interest rates, and that run of strength looks to have carried on into October,” said NAB chief economist Alan Oster.

“Overall, the survey suggests that firms are growing wary of the potential for a slower period ahead, despite ongoing strong demand.”

Although the Reserve Bank of Australia (RBA) increased interest rates by a total of 275 basis points to a nine-year peak of 2.85%, the NAB surveys have shown business activity exceeding all expectations for some months.

Consumer confidence has suffered greatly due to this tightening, but spending has held up well because of a 3.5% unemployment rate close to five-decade lows.

The dollar wavered on Wednesday as investors await U.S. inflation data and the outcome of the midterm elections, which could indicate a change in Washington’s power structure. The election outcome could cause some volatility in the pair.

AUD/USD key events today

Investors await a speech from Reserve Bank of Australia’s Assistant Governor Michele Bullock (RBA). She frequently drops hints about future monetary policy during her public appearances.

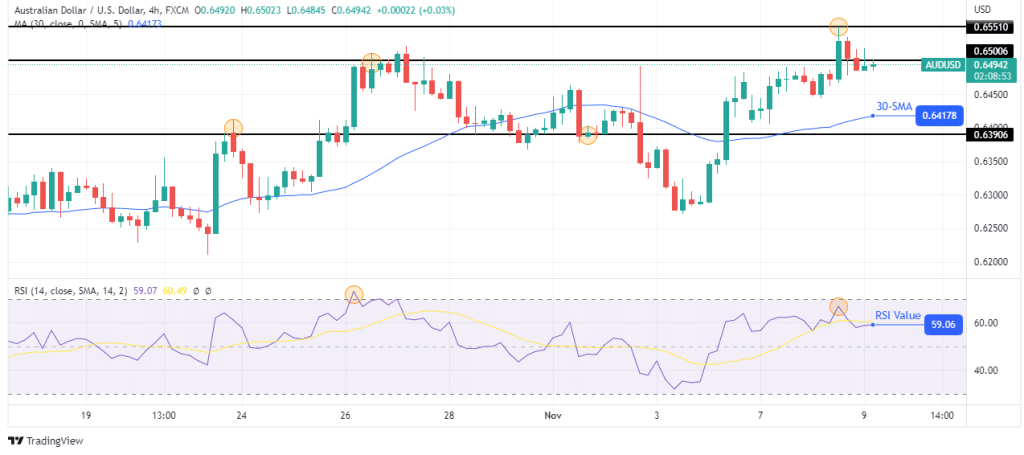

AUD/USD technical price analysis: Indecision as price chops through the 0.6500 key level

The 4-hour chart shows the price trading above the 30-SMA and the RSI above 50. This is a sign that bulls are in control. However, a closer look at the RSI shows weakness in the current bullish move. The price no longer has as much momentum as it did the last time it was trading near 0.6500, despite going above the level. It has paused at this level showing indecision on whether bears or bulls will take over.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

If bulls take over, they will likely take out the 0.6551 resistance. On the other hand, if bears take over, the price will retest the 30-SMA. A bearish reversal will only occur when the price breaks below the 30-SMA.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.