- AUD/USD continues Friday’s downtrend on Monday.

- Poor risk mood heavily weighs on the risk-sensitive Aussie.

- Market participants await the FOMC rate decision and press meeting to find fresh impetus.

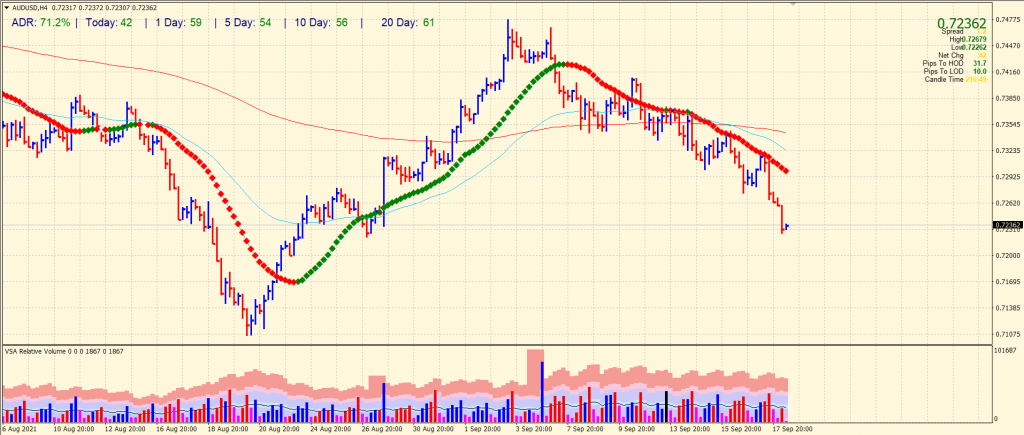

The AUD/USD price analysis reveals Monday’s Asian session at 0.7233, down 0.39% for the day. At the same time, two risk barometers react to an unpleasant mood.

-Are you looking for the best CFD broker? Check our detailed guide-

Recently, the collapse of China’s Evergrande and mixed updates on the Coronavirus have reduced risk appetite. Changes in the American economy, debt limits, or a recent multilateral agreement between the USA, UK, and Australia could also shake sentiment. To begin with, Wednesday’s cautious mood outside of the Federal Reserve’s Open Markets Committee (FOMC) is encouraging.

There have been 1,506 coronavirus cases in Australia since the third day of the easing of the virus. In contrast, Japan has also announced that the emergency associated with the virus in Tokyo is ending. However, COVID-19 numbers from New Zealand and China, India and the UK have caused no alarm and therefore bolster risk appetite.

According to Michigan Consumer Sentiment Index for September, it dropped from 72.20 to 71.0 on Friday but remained above 70.30 from earlier data. The same goes for the previously released US Consumer Price Index (CPI) and the increasing number of instances where Delta-Covid is being used to challenge the Fed’s hawkish stance. However, reliable retail sales and factory inflation data are likely to challenge the easy money proponents.

Senator Manchin, according to Axios, has postponed a vote on President Biden’s spending package until 2022. Reuters reported that US House of Representatives spokesman Pelosi expected a bipartisan approach to solving the debt ceiling problem.

Following these developments, the S&P 500 futures fell 0.30% on day three and fell close to a monthly low.

The bears will likely hold the reins for a while but will be hesitant because of the lack of any key event. Among the week’s key events is the Federal Reserve System (FRS) monetary policy decision.

-Are you looking for forex robots? Check our detailed guide-

AUD/USD price technical analysis: Market awaits more sellers

The AUD/USD is standing near a horizontal level of 0.7030. Meanwhile, the average daily range has covered 71% so far during the Asian session. It shows that there are bright chances of an upside correction. However, the volume is bearish; any upside attempt will be seen as an opportunity to sell. The downside targets lie at 0.7200 ahead of YTD lows at 0.7100. On the upside, immediate resistance lies at 0.7250 ahead of 0.7300.

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.