- AUD/USD stands on a slippery ground following its failure to respect upbeat Aussie Retail Sales data.

- Normal RSI conditions, break of short-term support direct sellers towards 200-HMA.

- Bulls need a sustained break of 0.7200 for return.

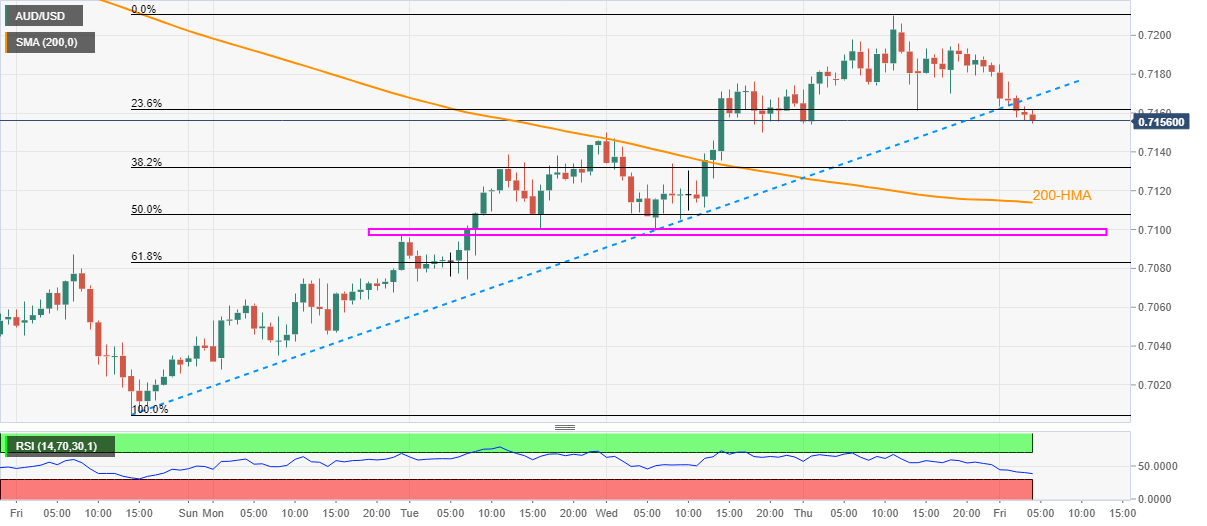

AUD/USD refreshes intraday low near 0.7155 during the pre-European session trading on Friday. In doing so, the pair fails to respect better than forecast prints of Aussie Retail Sales while extending its U-turn from 0.7210 marked on Thursday.

A clear break of the short-term support line, now resistance, joins an absence of oversold RSI conditions to favor the bears targeting the 200-HMA level of 0.7113.

Also acting as the key downside support is the 0.7100-7095 area comprising September 28 high and lows marked during September 29 and 30.

Alternatively, the pair’s bounce from the current levels will attack the trend line resistance, at 0.7167 now, to regain intraday buyers’ confidence. In doing so, the 0.7200 threshold could flash on the traders’ radar.

It should, however, be noted that Thursday’s high and September 09 low together highlight 0.7210 as the key upside barrier.

AUD/USD hourly chart

Trend: Bearish