- AUD/USD gained earlier on the day amid upbeat Chinese data.

- Broader rally in the Greenback keeps Aussie under pressure.

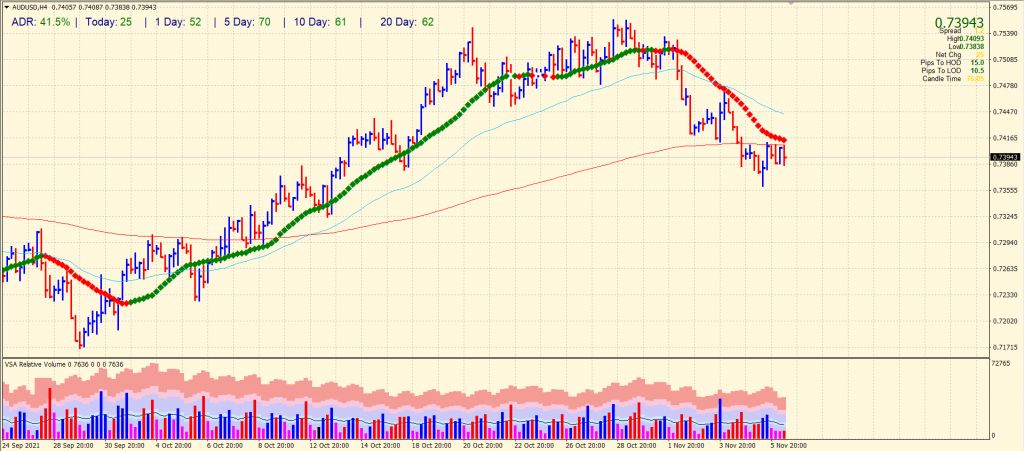

- The confluence of 20 and 200 SMAs continue to build bearish pressure.

The AUD/USD price analysis remains in favor of bears as the goodish momentum in the US dollar stemming from upbeat US NFP on Friday keeps the Aussie under pressure.

-If you are interested in knowing about ETF brokers, then read our guidelines to get started-

At the start of the trading week, Asia-Pacific markets will open with positive sentiment after positive Chinese trade data crosses borders. In October, China’s trade surplus grew to $84.54 billion. This is $20 billion more than analysts had predicted, according to Bloomberg research. In addition, export growth coupled with weaker than expected imports led to a surprising increase in cross-border transactions.

As Covid restrictions continue to ease in major economies, the record high indicates that global consumer appetite is growing. The weak imports during the month underscored China’s domestic woes, which were driven by the energy crisis and slower real estate market growth. Several measures have been taken by Chinese policymakers to affect economic activity as a result. October saw a slowdown in iron ore imports and an increase in coal imports.

Today’s economic data are weak, so traders will spend the weekend digesting China’s trade data. However, an extensive US infrastructure package may also inspire investors. The House of Representatives passed a $1 trillion economic package Friday evening, including billions of dollars for roads, bridges, ports, electric vehicle stations, and other projects.

China and Australia are expected to release inflation data later this week. There is potential for high impact from both of these events. According to Bloomberg, analysts expect China’s CPI to drop 1.4% y/y in October, while Australia’s employment change is expected to increase by 50,000 prints. A new round of yuan loans will also be issued later this week (October).

-Are you looking for high leveraged forex brokers? Take a look at our detailed guideline to get started-

AUD/USD price technical analysis: Key SMAs to kill bulls’ hopes

The AUD/USD price remains strongly rejected by the confluence of 20-period and 20-period SMAs on the 4-hour chart. The price may test Friday’s swing lows around mid-0.7300 ahead of 0.7300. On the upside, 0.7400-15 area will act as a stiff hurdle. If the hurdle zone is broken, the price may aim for a bull run towards 0.7450. The volume data is not at all convincing for the bulls. Any upside correction can be taken as a selling opportunity.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.