- AUD/USD sold-off into higher Treasury yields-driven US dollar strength.

- The 1H chart suggests more losses amid trendline breakdown, bearish crossover.

- Any bounce could meet strong offers at the 200-HMA barrier.

AUD/USD started out a fresh week on a bearish note, extending last week’s decline below 0.7800.

The aussie remains sold-off into increased US stimulus expectations-led rally in Treasury yields, which underpins the advance in the US dollar. Further, the US-Sino tensions over the Taiwan developments also likely weigh on the AUD, as markets shrug-off upbeat Chinese inflation data.

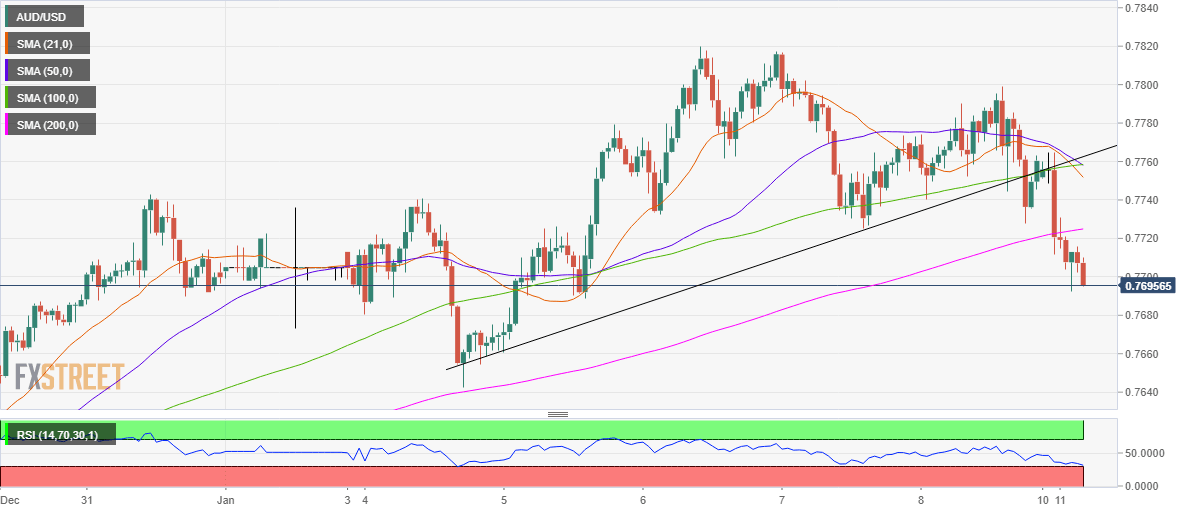

Technically, the selling pressure around the major intensified after the AUD bulls failed to defend the week-long rising trendline support at 0.7757 on the hourly chart.

The downside break bolstered the bears, as the critical upward-sloping 200- hourly moving average (HMA) support, then at 0.7722, also gave in.

A breach of the latter triggered a fresh leg lower, as the sellers cleared the 0.7700 cushion. The bearish crossover also adds credence to the renewed downside, as the 50-HMA seems to have just pierced the 100-HMA from above.

Meanwhile, the hourly Relative Strength Index (RSI) trends lower around 31.50, still holding above the oversold region, suggesting that there is more room to the downside.

AUD/USD: Hourly chart

AUD/USD: Additional levels