- AUD/USD refreshes the multi-month top before declining from 0.7945.

- Overbought RSI, bearish candlestick formation test further upside.

- Sellers target tops marked during April 2018 and January 2021.

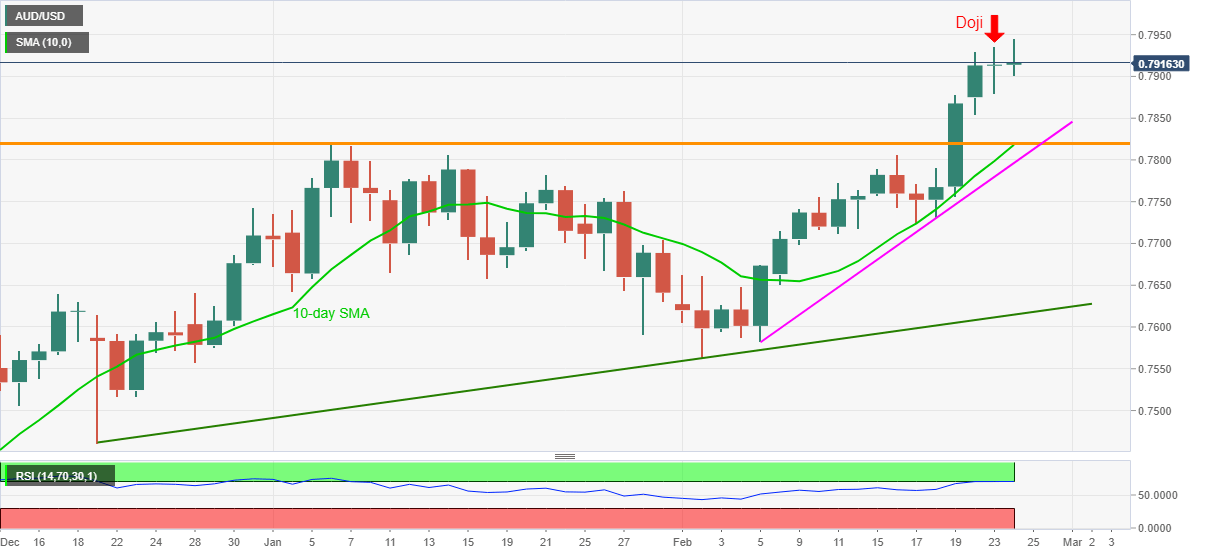

AUD/USD extends pullback from fresh 36-month high while declining to 0.7915 ahead of Wednesday’s European session. In doing so, the quote respects overbought RSI conditions and Doji candlestick formation flashed the previous day.

As a result, counter-trend traders eye further consolidation of the latest gains towards 0.7815-20 horizontal area, comprising highs marked in early 2018 and during the last month.

However, any further weakness will be challenged by a 10-day SMA and a three-week-old ascending trend line, respectively around 0.7820 and 0.7800.

Meanwhile, bulls need to reject the downtrend suggesting candlestick formation by a daily closing above 0.7940 to keep the reins.

Following that, February 2018 peak surrounding 0.7990 can test the run-up targeting the 0.8000 threshold.

To sum up, AUD/USD is up for a brief pullback before marking further upside.

AUD/USD daily chart

Trend: Pullback expected