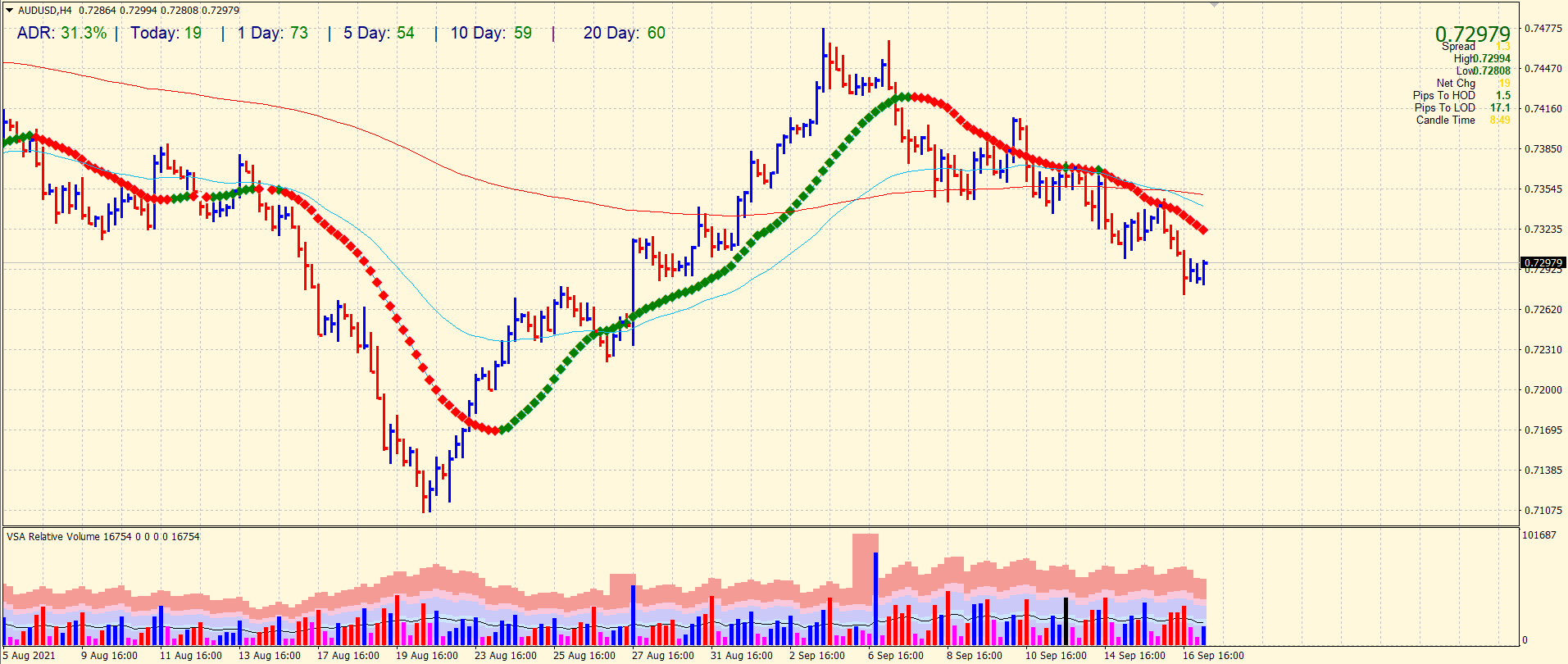

- AUD/USD consolidates losses around 0.7300 area after falling to 0.7272 (monthly lows).

- US dollar gained heavily on Thursday in the wake of upbeat US retails sales data.

- Risk sentiment remains off amid COVID-19 spread in Australia.

AUD/USD price consolidates recent losses around 0.7300 during Friday’s Asian session. Aussie declined to its lowest level as of August 27. The American dollar’s strength combined with the house’s backward catalysts was responsible for the drop. Yet, the absence of broad guidelines and general lackluster in Asian hours does seem to imply that the newest correction is needed.

-Are you looking for the best CFD broker? Check our detailed guide-

In a surprise move on Thursday, the US dollar index (DXY) made its strongest daily gains within a month on the back of strong retail orders in August and the Philadelphia production index for September. American retail sales were at the highest in five months, and the expectations are -0.8% change with + 0.7%. Furthermore, the Philly Fed gauge also reached 30.7 against the forecasts of 19.4, which is the highest number in the past three months.

In contrast to US data, Australia’s weekly COVID infections are mainly supported by the largest states, contributing to the sea haven demand of the US dollar.

Similarly, it was said the United States, United Kingdom, and Australia will be hosting Great Britain, India, Australia, and Japan for diplomatic negotiations next week to respond to China with the Security Agreement. In addition, a recent dispute between the US and China over Taiwan has exacerbated the risk sentiment.

While Wall Street is mixed, the 10-year US Treasury yield has grown by 3.2 basis points (bps) to 1.336% by Thursday’s end of the North American session. A further increase of 0.05% was seen for S&P 500 futures.

The preliminary measured values of the Michigan consumer value index for September were expected to be 72.2, while the corresponding figure for August was 70.3.

While there is no significant data or events, concerns from the Fed about Fed Cash Back during next week’s Federal Committee on Open Markets (FOMC) can keep AUD/USD prices weak. The negative side also includes the fears of COVID-19 and the Chinese tensions with the United States to not miss the Canberra-Beijing tussles.

-Are you looking for forex robots? Check our detailed guide-

AUD/USD price technical analysis: Bears overcome 0.7300

The AUD/USD price saw a breakout below the 0.7300 mark. The pair hit the monthly lows at 0.7272. However, the pair managed to return to the 0.7300 level. But the volume is too low. It shows that the bearish bias remains intact. The pair may find some selling around 0.7300 area that may lead to the 0.7250 level.

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.