- AUD/USD gains on better retail sales data.

- China’s sluggish investor sentiment and dismal GDP projection may weigh on the Aussie.

- The rise in US yields and Powell’s testimony may question the Aussie bulls.

The AUD/USD price traded up 0.34% at 0.7305 after earlier data showing Australian retail sales decreased 1.7% from the previous month.

Australia’s Retail Sales for August improved from -2.7% to -1.7% from -2.5% expected. The Industrial Profits in China were down 10.1% YoY versus 16.4% expected.

-Are you looking for automated trading? Check our detailed guide-

In addition to mixed data from Australia and China, sluggish investor sentiment contributes to the recent weakness in the AUD/USD pair.

WSJ reports that a power outage in Beijing has led to a new chip scarcity threat, as Goldman Sachs reported. “The economic recovery in East Asia and the Pacific will fail,” the World Bank told Reuters, adding that China’s GDP would fall to 8.5% in 2021.

AUD/USD sellers are being tested on the flip side by poor home Covid scores and optimism about hitting Australia’s 80 percent vaccination target. Additionally, there was talk of the West’s economy recovering after the pandemic and Britain’s interest in joining the Comprehensive and Progressive Trans-Pacific Partnership Agreement (CPTPP).

On Monday, the 10-year US bond yield briefly topped 1.5%, a level not seen since June 2021, and the 2-year bond yield hit its highest level since March 2020. Due to the Bank of Japan’s policy of controlling yield curves to keep them near zero, investors were attracted by the yields on 10-year Japanese government bonds.

Also, Fed Chairman Powell’s testimony on the day may put the AUD/USD bulls in doubt. Investors will likely find the tapering clues and rate hike from the speech.

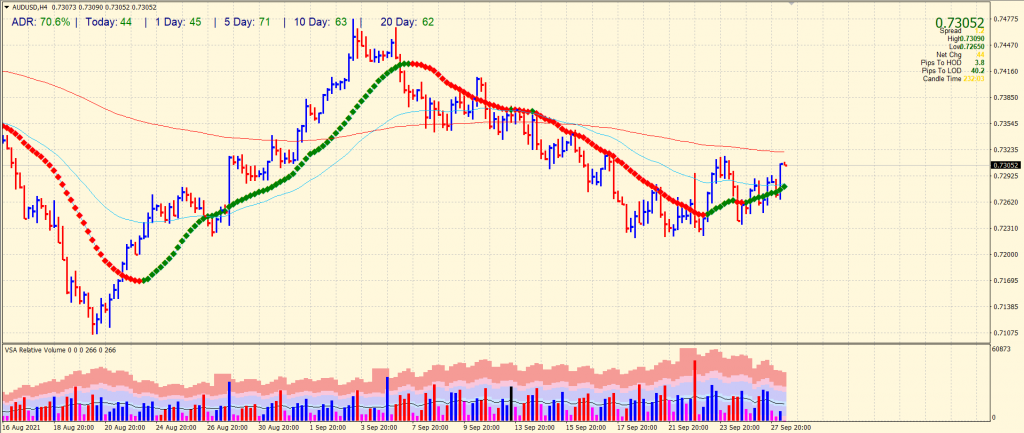

AUD/USD price technical analysis: 20-SMA remains the key

The AUD/USD price gained beyond the 0.7300 handle as the bulls found some traction near the 20-period SMA on the 4-hour chart. The next key hurdle is 200-SMA around 0.7330 area that may test the bulls’ strength. The next resistance levels are at 0.7350 followed by 0.7400. On the flip side, breaking below the 20-period SMA at 0.7280 may lead towards the horizontal level of 0.7230.

The average daily range for the pair is 67% so far which indicates a volatile market environment. However, the volume does not support the bulls as the volume for the last few bars was too thin to justify the surge of more than 30 pips.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.