- AUD/USD has found temporary support, and now it tries to come back higher as the DXY is trading in the red.

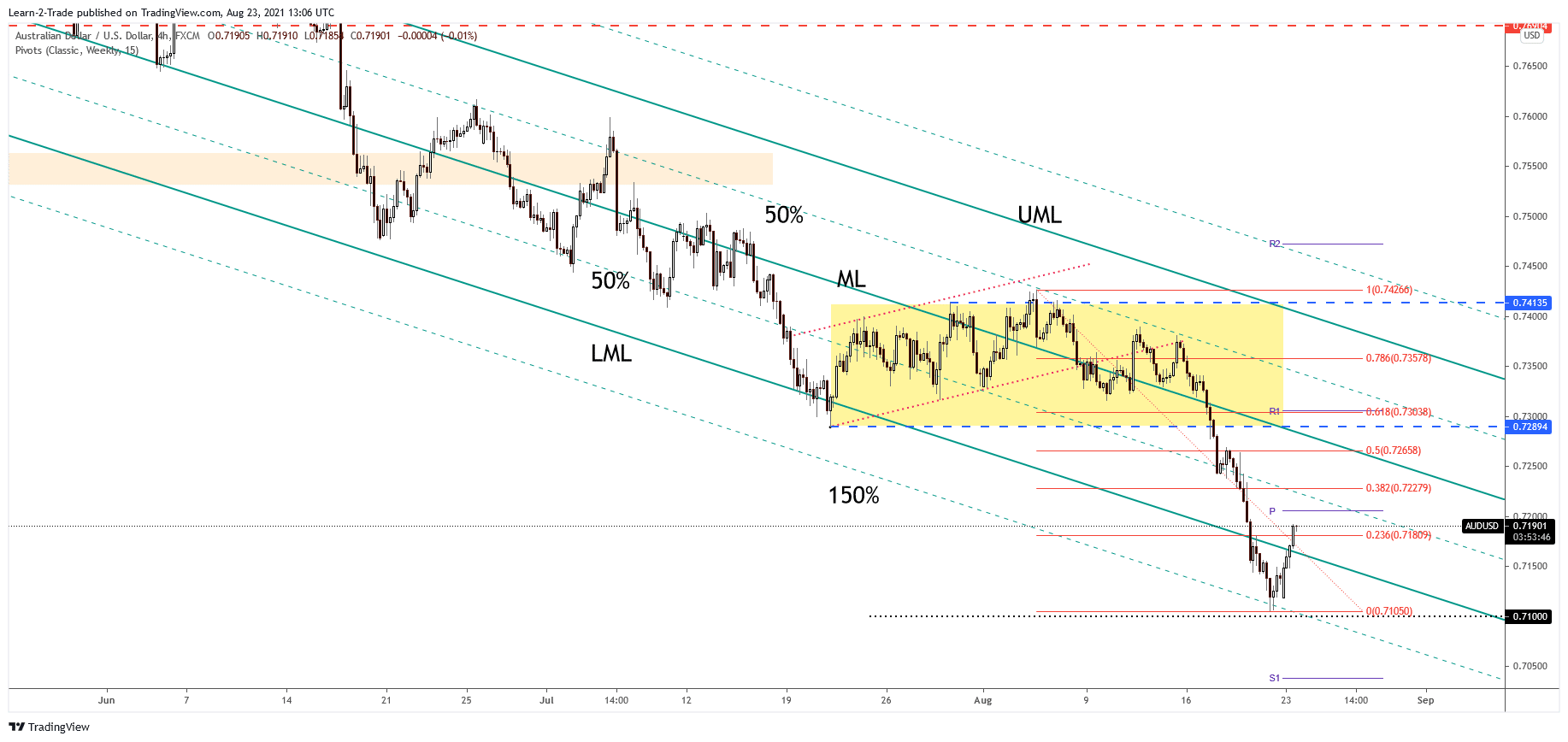

- The median line (ML) of the descending pitchfork is seen as a strong resistance level.

- Ending its current rebound could help us to catch a new downwards movement.

The AUD/USD price rebounded, and it tries to recover after an amazing sell-off. Unfortunately, DXY’s corrective phase forced the greenback to depreciate versus its rivals.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

As a result, the Dollar Index has dropped significantly and now is located around 93.17 below 93.19 static support.

The Aussie has gained even though the Australian Flash Manufacturing PMI has dropped from 56.9 points to 51.7 points, while the Flash Services PMI dropped from 44.2 points to 43.3. On the other hand, the United States economic data has come in worse than expected. The Flash Services PMI dropped unexpectedly from 59.9 points to 55.2 points in August, while the Flash Manufacturing PMI was reported at 55.2 versus 59.1 expected and after 63.4 points in July.

The US Existing Home Sales have risen from 5.87M to 5.99M, exceeding 5.82M. So only DXY’s rebound could really push the AUD pair lower again.

AUD/USD price technical analysis: Can bulls continue the pullback?

From the technical point of view, the AUD/USD pair has found support on the downside 150% Fibonacci line of the descending pitchfork failing to reach the 0.71 psychological level. Now, it stands at 0.7189 level above the 23.6% retracement level.

–Are you interested to learn more about forex signals? Check our detailed guide-

The immediate upside target stands at the weekly pivot point of 0.7205 level. The descending pitchfork’s median line is seen as a major resistance, upside obstacle in the short term. Failing to stabilize under the lower median line (LML) could signal a strong rebound. Still, it’s premature to discuss a significant leg higher because the Dollar Index is still bullish despite the current decline.

Technically, the AUD/USD pair could help us catch a new downside movement after ending its current bounceback. On the other hand, a minor consolidation above the 23.6% retracement level could signal further growth.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.