- As the AUD / USD pair retreats from an intraday high, it cannot resume Friday’s gains.

- Following the release of US CPI data on Friday, the market begins the key week cautiously optimistic.

- Dalian’s iron ore futures rose more than 5%, while Asia Pacific stocks traded in different directions.

- A data dump from China could provide an intermediate route ahead of the Fed’s decision and Australian employment report.

The AUD/USD price loses Friday’s recovery gains, falling to 0.7165 ahead of Monday’s European session despite strong sentiment.

–Are you interested to learn more about Forex demo accounts? Check our detailed guide-

Initial market optimism and news of Australian and Chinese incentives to reduce initial losses were welcome to the Australian pair. However, the market is still concerned about upcoming major events later this week, putting pressure on current prices.

Reports indicate that Australia’s treasurer Friedenberg will announce the extension of the state loan guarantee program on Monday, which expires in late December. At the annual Central Economic Working Conference, Chinese politicians committed themselves to stabilize the world’s second-largest economy in 2022 with monetary and fiscal policy instruments.

Increased prices for iron ore, which is Australia’s largest export item, are also positive for the AUD / USD pair. Reuters reported during the Asian session that iron ore futures for delivery in May 2021 will rise over 5.0% to 671 yuan ($105.46) per ton.

The US Consumer Price Index (CPI) data released on Friday contributed to AUD / USD prices and market sentiment as inflation data was in line with expectations for November. Furthermore, according to the Federal Reserve System of St. Louis (FRED) 10-year break-even level, buyers of the pair also benefited from lower inflation expectations in the US.

The widespread outbreak of Omicron covid (a type of parasite) in South Africa has caused political hawks to predict further inflation and the need for tighter policy. Despite this, market fears of a faster tightening and rate hike aren’t yet subsiding. It is also being discussed to stop the production of some Chinese companies in Zhejiang province and postpone SenseTime’s $ 767 million IPO in Hong Kong.

In the midst of these events, the yield on 10-year US Treasuries fell to around 1.49%, while futures on US stocks saw moderate gains, and stocks in Asia-Pacific moved in different directions.

As both the AUD and USD lack key data on the day, traders will be cautious going forward. However, data from China on Wednesday could provide temporary relief to the pair’s optimists before the Fed’s verdict is released.

–Are you interested to learn more about CFD brokers? Check our detailed guide-

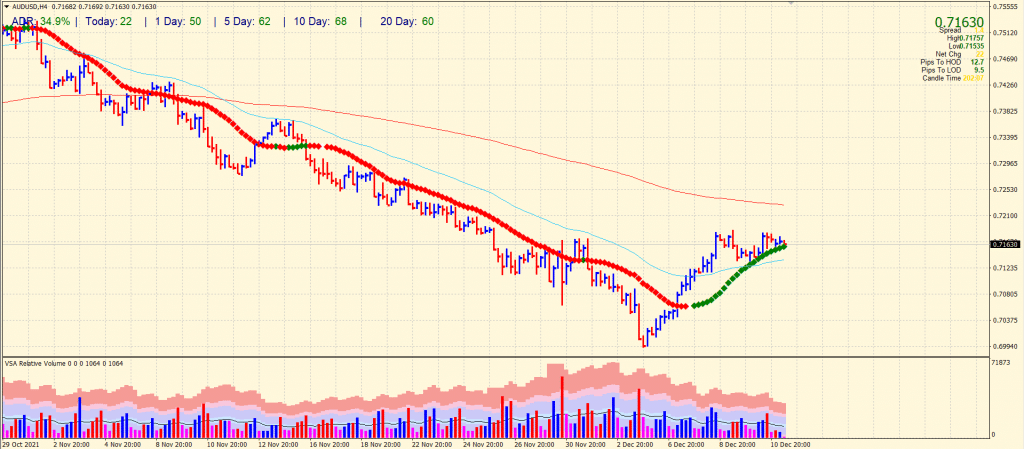

AUD/USD price technical analysis: Signs of weakness

The AUD/USD price looks feeble around 20-period SMA on the 4-hour chart. After a gain, the narrow-spread bars show weakness signs and may reverse the gains. The pair is likely to stay between 0.7100 to 0.7200. The volume data shows signs of bearish action on the chart.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.