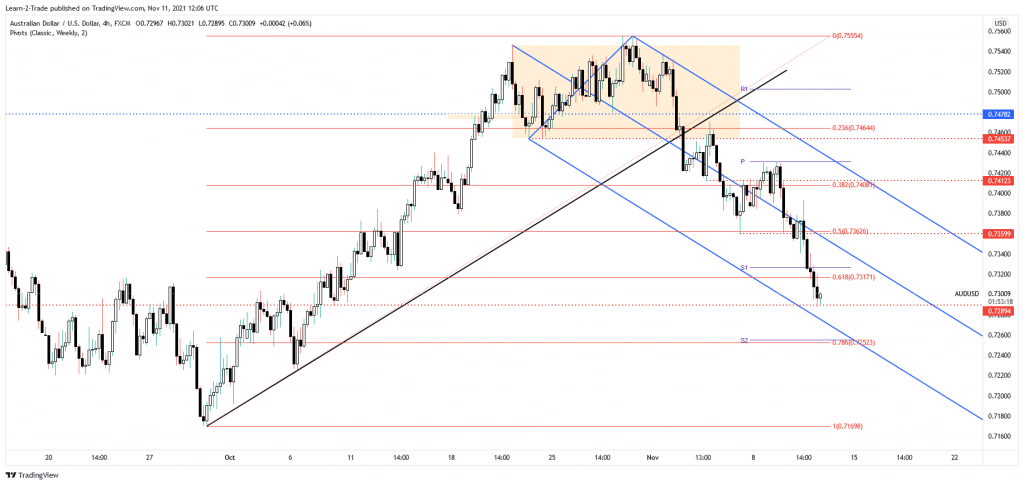

- The AUD/USD pair could extend its downside movement as long as it stays under the 61.8% retracement level.

- A minor sideways movement could bring fresh selling opportunities.

- The descending pitchfork’s lower median line could be used as a downside target.

The AUD/USD price dropped as much as 0.7287 level today, where it has found support. Technically, the price reached the 0.7289 level, which stands as a historical support. Thus, the pressure remains high despite a temporary rebound. The currency pair could drop deeper anytime, so you should be careful.

-Are you looking for CFD brokers? Take a look at our detailed guideline to get started-

The price could rebound only because the Dollar Index is trading in the red in the short term. The DXY could slip lower. It could come back down to test and retest the broken levels before jumping higher. The index is trading at 94.95 level below 95.09 today high. Don’t forget that the US Dollar Index is bullish. It could end its minor retreat soon.

Fundamentally, the Aussie received a hit from the Australian Employment Change, which was reported at -46.3 even if the traders had expected the indicator at 50.0K. It has remained deep in the negative territory after -141.1K in the previous reporting period.

Furthermore, the Unemployment Rate registered an unexpected growth from 4.6% to 5.2% jumping far above 4.8% expected.

Today, the US banks will be closed in observance of Veterans Day, so maybe the volatility will be low.

AUD/USD price technical analysis: Key levels to watch

The AUD/USD pair is trading in the green at 0.7308 after registering only a false breakdown below the 0.7289 key level. It maintains a bearish bias. The pressure is high as long as it stays below the 61.8% retracement level and under the descending pitchfork’s median line.

-If you are interested in knowing about scalping forex brokers, then read our guidelines to get started-

If the AUD/USD pair drops deeper, the descending pitchfork’s lower median line is a potential downside target. Also, stabilizing under the 61.8% retracement level could signal a potential bearish reversal. A minor sideways movement, a distribution, could bring new short opportunities. Taking out the 0.7289 obstacle could confirm more declines. Personally, I believe that only coming back and stabilizing above the descending pitchfork’s median line could announce that the downside movement is over.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.