- The AUD/USD pair gained positive momentum on Wednesday due to a number of factors.

- Riskier Aussies benefited from equity market stability and RBA interest rate hikes.

- Investors, however, opted to stay on the sidelines ahead of the crucial FOMC decision.

During the European session, the AUD/USD price has been trading with a positive bias and was last seen near-daily highs around 0.7150.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

The AUD/USD pair regained positive momentum on Wednesday, helped along by a combination of factors. A perceived riskier Aussie benefitted from signs of stability in global equity markets and expectations of an earlier rate hike by the Reserve Bank of Australia.

In Australia, the CPI report on Tuesday led to speculation that the RBA will end its bond-buying program at its upcoming meeting, opening the door to rate hikes this year. Overall, the CPI rose 1.3% in the fourth quarter, bringing the annual rate up to 3.5%. Additionally, the core CPI exceeded the Reserve Bank’s average target of 2-3% for the first time since June 2014.

Alternatively, the US dollar consolidated its recent gains to a two-week high and remains well supported by expectations that the Fed will tighten monetary policy faster than expected. Markets believe the US Federal Reserve will raise interest rates in March, and the Fed has already hiked four times this year.

Due to this, the emphasis will remain on the outcome of the two-day monetary policy meeting of the Fed, which will be announced during the US meeting. Investors can avoid placing aggressive directional bets and instead sit on the sidelines, stepping into key event risk.

The recent break below the uptrend channel that extends from the 2021 low is urging optimistic traders to exercise caution, even from a technical standpoint. It would be prudent to wait for strong follow-on buying before confirming that AUD/USD has formed a strong base near 0.7090 and positioning it for any meaningful uptrend.

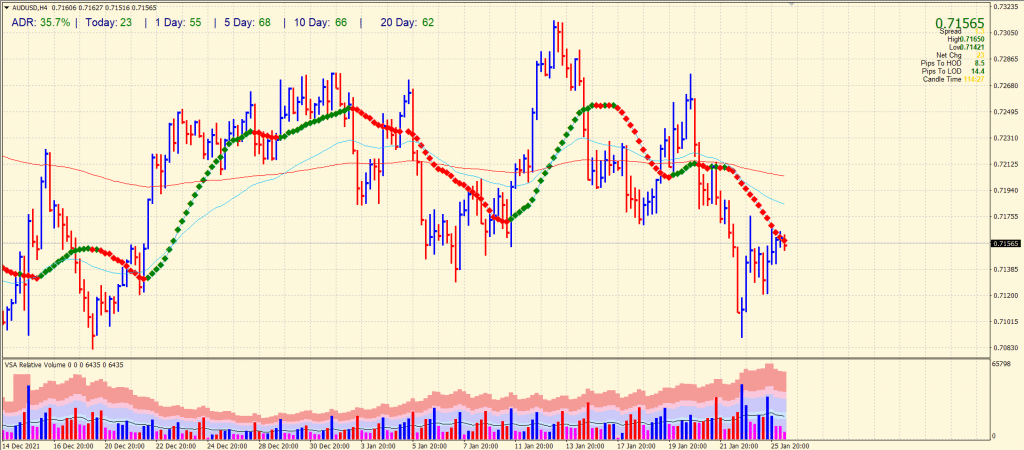

AUD/USD price technical analysis: Bulls run out of steam

The AUD/USD price recovery stalls near the 20-period SMA on the 4-hour chart. Moreover, an upthrust bar with a high volume around the 20-period SMA shows that the pair lacks the strength to gain further. In any case, the rally will be limited below 0.7200 mark. On the flip side, the pair may seek refuge at 0.7100 support ahead of 0.7050 and 0.6990.

–Are you interested to learn more about ETF brokers? Check our detailed guide-

As of now, the market seems sidelined and awaits any catalyst to trigger directional bias.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.