- The AUD/USD exchange rate fell from a two-week high hit earlier this week as the dollar strengthened.

- Safe-haven dollars have benefited from the Fed’s dovish outlook and cautious attitude.

- The Australian dollar was bolstered by rising commodities prices, limiting further losses.

The AUD/USD price declined during the European session and was last seen around the 0.7400 round mark, near the bottom of its daily range.

–Are you interested in learning more about STP brokers? Check our detailed guide-

The pair has seen a modest pullback from the two-week high hit earlier this Monday at 0.7425 and appears to have ended its winning streak of four consecutive days. A perceived riskier Aussie was countered by dovish market sentiment. With this and the emergence of some US dollar buying, the AUD/USD pair has been put under downward pressure.

As Russian forces bombard Kyiv with heavy airstrikes, investors remain nervous as hopes for a peace deal to end the war in Ukraine persists. This dampened recent optimism in the markets and benefited the safe-haven dollar, further boosted by the Fed’s dovish stance. The Fed hinted that it could raise rates at all six remaining meetings in 2022.

In addition, comments from influential members of the FOMC and higher US Treasury yields further bolstered bullish sentiment. Louis Fed President James Bullard explained why he voted for a 50 basis point rate hike and said on Friday that the central bank’s reputation would be at stake if it did not act fast enough.

Fed Chair Christopher Waller also noted that he did not push for a rate hike of 50 basis points because of the war in Ukraine, though it would be discussed at future meetings. As a result, the benchmark 10-year Treasury notes yield remained below its highest level since June 2019.

However, the Australian dollar and the AUD/USD could benefit from rising commodity prices. Investors may also refrain from aggressive interest rates and wait for Jerome Powell’s speech during the US meeting on Monday.

AUD/USD price technical analysis: Bulls retreating

–Are you interested in learning more about forex bonuses? Check our detailed guide-

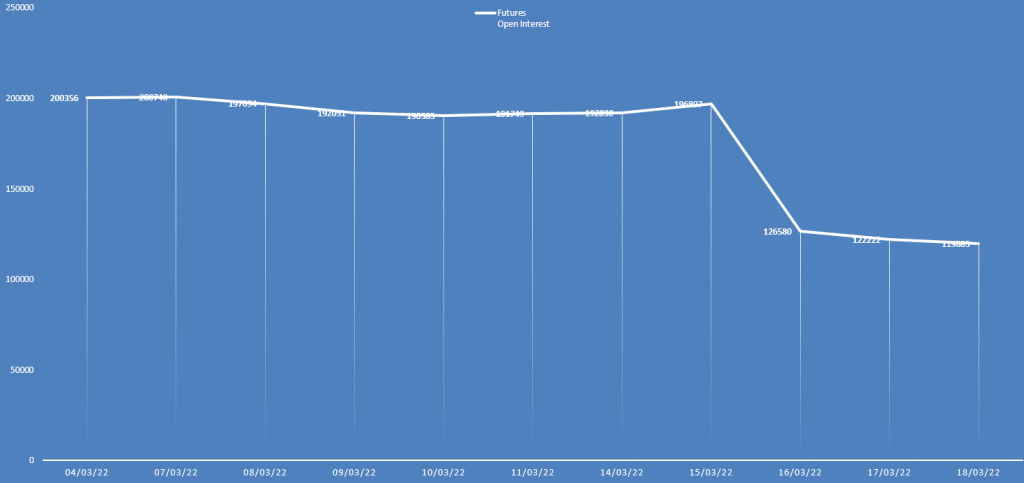

AUD/USD analysis via daily open interest

The AUD/USD price rose on Friday while the open interest dropped slightly. It indicates mildly bearish behavior.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money