- The AUD/USD pair is resting on the 30-SMA support level.

- Investors are not surprised by FOMC minutes, which emphasize rate hikes.

- Investors expect retail sales from Australia to move the AUD/USD.

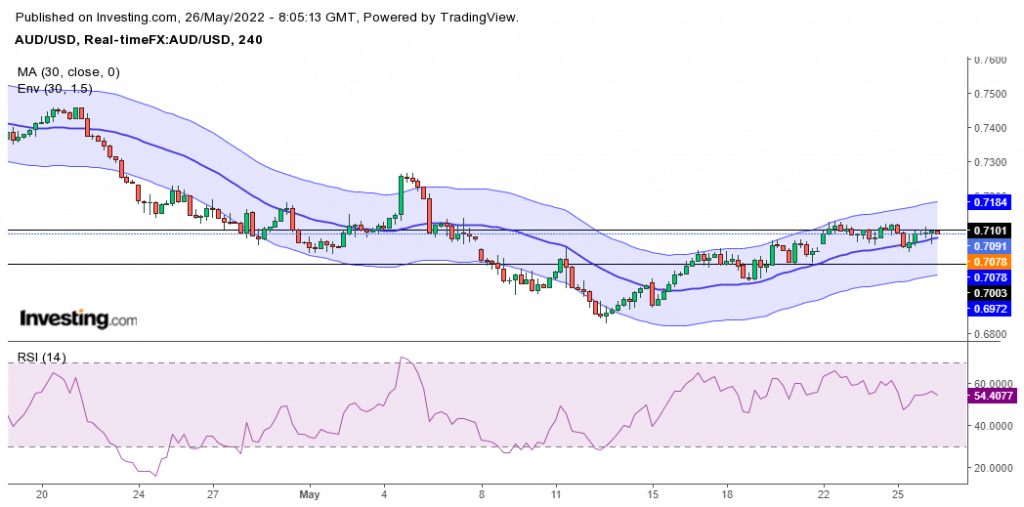

The AUD/USD price traded below 0.7100 on Thursday morning after it failed to break above the critical level on Wednesday. It saw little volatility yesterday, with prices making highs at 0.71193 and lows at 0.70355. Prices failed to close above 0.7100 as bulls showed weakness during the quiet session.

–Are you interested in learning more about British Trade Platform Review? Check our detailed guide-

The FOMC meeting minutes were released yesterday, causing AUD/USD to recover some losses from daily lows. The minutes revealed that officials supported hikes of 50bps in June and July.

The FOMC’s May meeting approved a half percentage point hike, and they have laid out a plan to reduce the central bank’s $9 trillion balance sheet. Statements in the minutes show that the committee is willing to do more than the market anticipates. “All participants reaffirmed their strong commitment and determination to take the measures necessary to restore price stability.”

In the minutes released yesterday, inflation was a primary concern, as it was mentioned 60 times, despite confidence that the tighter monetary policy would help the situation. The US dollar went as low as 101.75 but was able to recover losses to 102.066 yesterday and has maintained this price since Thursday morning.

AUD/USD key events today

Investors will be paying attention to retail sales MoM data coming from Australia for May. The value for April was 1.6%, and investors expect it to drop to 0.9%. A value higher than 0.9% would be bullish for AUD/USD and could send the pair higher. Investors will be looking out for the GDP (QoQ) (Q1) from the US. Investors expect the previous value of -1.4% to go up to -1.3%. They expect initial jobless claims values to fall from 218K to 215K.

–Are you interested in learning more about buying NFT tokens? Check our detailed guide-

AUD/USD price technical analysis: Support at the 30-SMA

The 4-hour chart shows the price resting between 0.7100 and the 30-SMA. Bulls have not yet taken over this market as RSI values remain below 70. There is, however, the possibility that we could see prices bounce off the 30-SMA, which has been used as support on previous occasions to the upside. A break in the SMA could, however, mean the return of the bears.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money