- The AUD/USD pair drops like a rock after failing to confirm a larger rebound.

- A new lower low could activate more declines.

- Its failure to stay above the weekly S1 signaled a new sell-off.

The AUD/USD price plunged after failing to activate a meaningful recovery. The bias is bearish, so a further drop is in the cards.

–Are you interested to learn more about forex options trading? Check our detailed guide-

Technically, the price bounced back only because the Dollar Index retreated after its strong rally. After its massive drop, the currency pair was expected to come back to test and retest the near-term resistance levels before dropping deeper. The pair was trading at 0.6733 at the time of writing, and it seems determined to approach and reach at least the 0.6710 lower low.

Yesterday, the AUD/USD pair registered sharp movements in both directions after the US inflation data and after the BOC. The US CPI and the Core CPI reported higher inflation, while the Bank of Canada increased the Overnight Rate from 1.50% to 2.50%, above 2.25% expected.

Now, the price has dropped like a rock as the Dollar Index rallied. Fundamentally, the Australian economic data came in better than expected, but the AUD continues to drop versus the greenback. The Unemployment Rate dropped unexpectedly lower from 3.9% to 3.5%, below 3.8% expected, while the Employment Change came in at 88.4K above the 30.0K forecast.

Later, the US PPI, Core PPI, and the Unemployment Claims could bring more volatility and strong action. Tomorrow, the US retail sales data could shake the markets. Still, the USD maintains a bullish bias as the FED is expected to hike rates again in the July meeting.

AUD/USD price technical analysis: Sell-off continues below 0.68

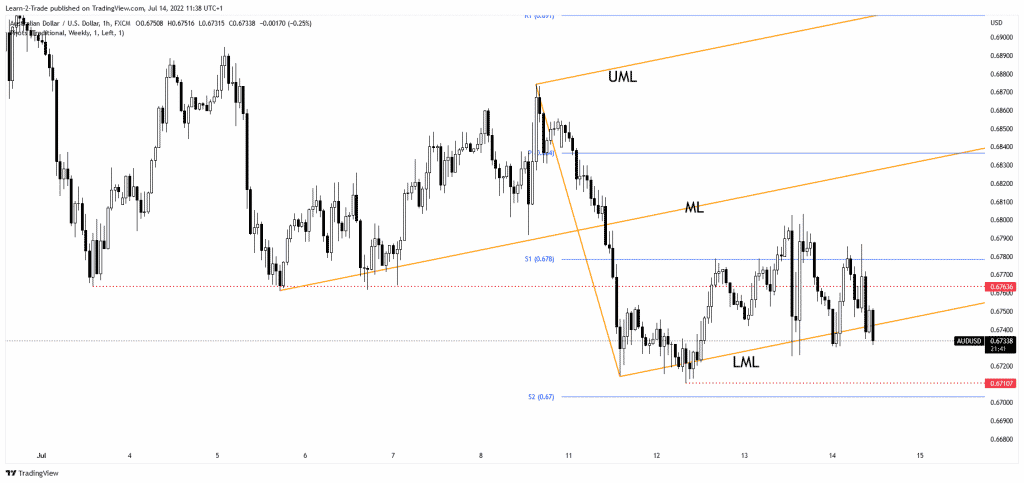

As you can see on the 1-hour chart, the AUD/USD pair failed to stabilize above the weekly S1 (0.6778), signaling that the rebound could be over. It has registered only false breakout above the 0.6763 key level.

–Are you interested to learn about forex robots? Check our detailed guide-

The pair has dropped again below the ascending pitchfork’s lower median line (LML), representing dynamic support. The 0.6710 former low could be used as a downside obstacle as a potential target. Also, the weekly S2 (0.6703) stands as a downside obstacle. Taking out these support levels could activate a further drop.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money