- The AUD/USD continues recovering from a five-week low in Asia on stronger Australian inflation data.

- Despite Australia’s fourth-quarter CPI and RBA trimmed average consumer price index beating expectations, NAB December data was below expectations.

- With all eyes on Wednesday’s FOMC meeting, consumer confidence will be a bright spot on the calendar.

The AUD/USD price rose 25 points to 0.7175 after Australian fourth-quarter inflation data came out earlier Tuesday, stronger than expected.

–Are you interested to learn more about ETF brokers? Check our detailed guide-

Aussie losses initially consolidated at their lowest levels since late December, amid cautious optimism about the Pacific major, mainly the South African variant of the Omicron coronavirus.

The Consumer Price Index (CPI) in Australia rose by more than 1.0% quarter-on-quarter and by 0.8% quarter-on-quarter to 1.3% in the fourth quarter (Q4). In comparison, the year-on-year figure beat the Reserve Bank of Australia’s forecast of 3.5%, surpassing 3.2% expected and 3.0% provisional. Additionally, the RBA’s trimmed average consumer price index beat the market consensus by 0.7% to 1.0% q/q and beat forecasts from 2.4% to 2.6% y/y.

The National Bank of Australia (NAB) data for business sentiment and conditions for December turned gloomy since the former fell to -12 from a forecast of 16, while the latter declined from 8 to 12.

The CPI is coming up in Australia soon, so let’s refrain from writing about it again. Clearly, the number makes a big difference. Firstly, the RBA may have to admit that a rate hike in 2022 is no longer out of the question. ANZ said in advance of releasing the key inflation data that the cost of living could become a key issue in the upcoming federal election.

In addition to Australia’s recent easing of Coronavirus cases, there have been encouraging headlines from Evergrande, which also favor AUD/USD buyers.

Due to its status as a risk barometer, AUD/USD is being impacted by fears of a Fed rate hike and rhetoric over Russia and Ukraine.

US 10-year Treasury yields are firming at 1.78%, while US equity futures and Australia’s ASX 200 are losing money on the latest report.

The CBR consumer confidence index for January ahead of 115.8 will be a key figure for the USD/JPY pair. The focus will, however, be on risk catalysts.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

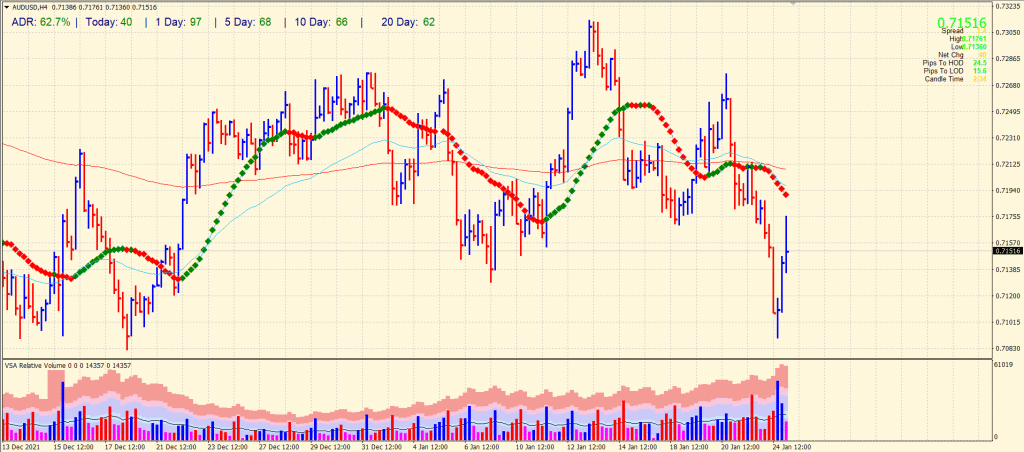

AUD/USD price technical analysis: Bears diminishing above 0.7150

The AUD/USD price recovered more than 90 pips from under the 0.7100 mark. However, the price could not sustain near the highs of 0.7175 and pared off partial gains. The bias is neutral at the moment as the pair is wobbling around the mid-0.7100 orderblock zone and may keep consolidating the gains.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.