- AUD/USD drops after Lowe’s speech and monetary policy statement.

- RBA Governor expects economic recovery if restrictions are lifted.

- The surge in US Treasury yields may keep pressure on the Aussie.

The AUD/USD price dropped by 0.24% in one day, as it retraced Thursday’s gains to close at 0.7384 early Friday.

The Australian dollar ignores the cautious optimism cited by the Reserve Bank of Australia (RBA) quarterly monetary policy announcement (SOMP) as risk catalysts play a role.

–Are you interested to learn more about automated forex trading? Check our detailed guide-

SOMP’s long-term forecast for GDP has been lowered, but the RBA remains optimistic about continued economic growth. As a result, it is anticipated that the curtailed median CPI will remain unchanged at 1.75% in 2021 and 2022, according to the Australian central bank.

The RBA Governor spoke before the House Standing Committee on Economics earlier. In addition to citing Covid concerns, the politician said: “The economy is expected to recover quickly if restrictions are lifted.”

In response, cautious optimism can be observed in recent RBA reports, whether with the latest monetary policy meeting or the governor’s remarks.

Recent events in the US, China, and Australia have kept the AUD/USD under pressure. As of the latest update, the US has seen a significant increase in Coronado cases in the past 6 months. Likewise, China has had a significant increase in the rate of Coronavirus infection this year. In addition, Covid data for Australia is also updating its highest values since August 2020, with no later than 307 in the country.

The US Senate’s failure to reveal details of expected infrastructure spending today is expected to join the NFP tantrum and caution to sway risk appetite as well as the AUD/USD.

In addition, central banks from UK, US, and Australia are giving some thought to concerns about Delta-Covid. Additionally, the recent positive surprise from US unemployment claims seems to depress pessimists.

The S&P 500 futures retreated from record highs amidst these events, and Australian stocks sank. Furthermore, the 10-year US Treasury yield rose by 1.3 basis points (bp) to 1.22% on Thursday, marking its sharpest rise in 12 days.

A few hours may pass before the pre-NFP trading lull hits the AUD/USD pair following today’s Chinese trade numbers and recent risk catalyst.

COVID fears in Australia

As Sydney’s population endured record COVID-19 cases for the second straight day despite a week of isolation to contain the Delta outbreak, officials warned residents to be prepared for a spike.

According to Sydney’s Health Department, there have been 279 localized cases of COVID-19 infection in the past 24 hours, up from the previous high of 259 several days ago. The number of cases reported by New South Wales increased from 262 to 291. One more person has died in Sydney in the last outbreak, bringing the total to 22 in the state.

–Are you interested to learn more about forex signals? Check our detailed guide-

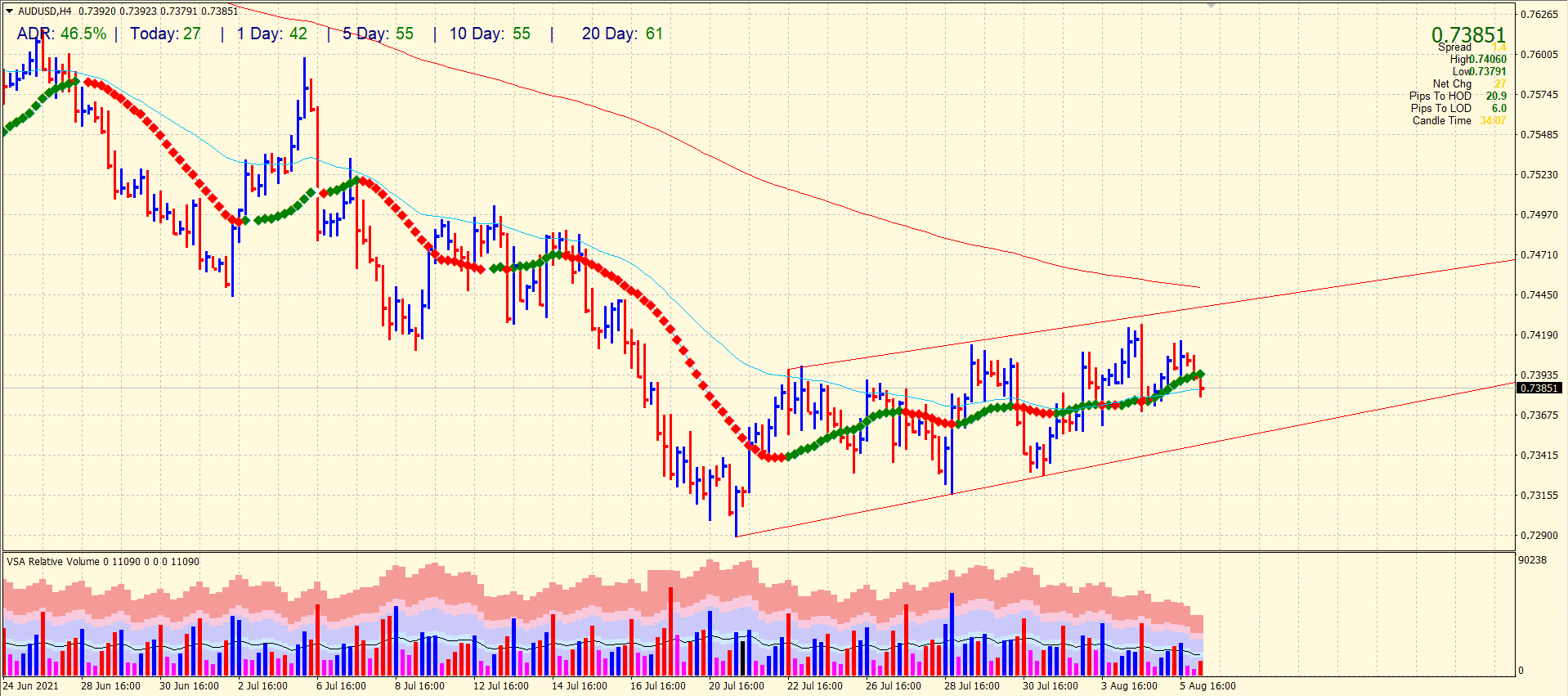

AUD/USD price technical analysis: Uptrend channel to hold

The price slips below the key figure of 0.7400, sliding below the 20-period SMA on the 4-hour chart. However, the 50-period SMA continues to provide interim support at the moment. The price is still within the uptrend channel. Volume for the recent down wave does not support selling. Therefore, it can only be a retracement. As long as the price remains within the channel, it will be considered neutral.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.