- AUD/USD rises after RBA’s interest rate decision and statement.

- Delta variant cases are declining in Australia.

- Greenback remains on the backfoot, investors to look for risk sentiment.

The AUD/USD price spikes to 0.7400 handle as Australia’s Reserve Bank (RBA) set a record interest rate of 0.10% in August. As of early September, the central bank intends to continue to taper the bond-buying program.

–Are you interested to learn more about automated forex trading? Check our detailed guide-

From early September until mid-November, the Reserve Bank of Australia will continue to purchase government securities at the rate of $4 billion a week.

A bullish outlook is seen for AUD/USD, which is currently trading 0.7402, or 0.40% ahead of European trading. Upon hearing the Reserve Bank of Australia’s (RBA) announcement, the Australian Dollar spiked.

The RBA did not make any changes to its interest rate or bond purchase program, as widely expected. While markets anticipated a bearish tone from the RBA, its willingness to maintain the tapering plan in September lured the bulls much to the detriment of the market.

While cautious sentiment prevailed ahead of the RBA, the AUD/USD exchange rate remained sidelined. Nevertheless, the Australian pair ignored Moody’s upbeat forecasts of a stronger Asian recovery following the pandemic and the International Monetary Fund’s (IMF’s) historical allocation of $650 billion to Special Drawing Rights (SDRs) for the region.

Furthermore, on the past two days of reduction in the number of new covid infections in Australia, the pair buyers were unimpressed too. This is the second day in a row in which virus counts have fallen, and New South Wales is now down to 200, bringing the Australian total to 223. As per Reuters, global rating giant Moody’s predicted that Asia-Pacific’s economic activity will rebound in 2021 and 2022, on par with recent performance.

The US Centers for Disease Control and Prevention (CDC) were also concerned, stating that the Delta variant was likely to be more severe than the earlier versions, as per Reuters.

Further, lower than expected figures for both the US and Chinese purchasing managers’ indexes, along with housing data for Australia, published earlier in Asia, dampened the correction.

Despite steady US 10-year Treasury yields, the US Dollar Index (DXY) has remained indecisive around 92.00 as of Tuesday, postponing the lowest daily closing since February. Despite a downbeat start to the week on Wall Street, the S&P 500 Futures recorded an intraday gain of 0.18%.

–Are you interested to learn more about forex trading apps? Check our detailed guide-

As the AUD/USD markets remain focused on the risk catalyst for fresh impulse amid a light calendar elsewhere, they will keep an eye on the initial reaction to RBA’s monetary policy announcement.

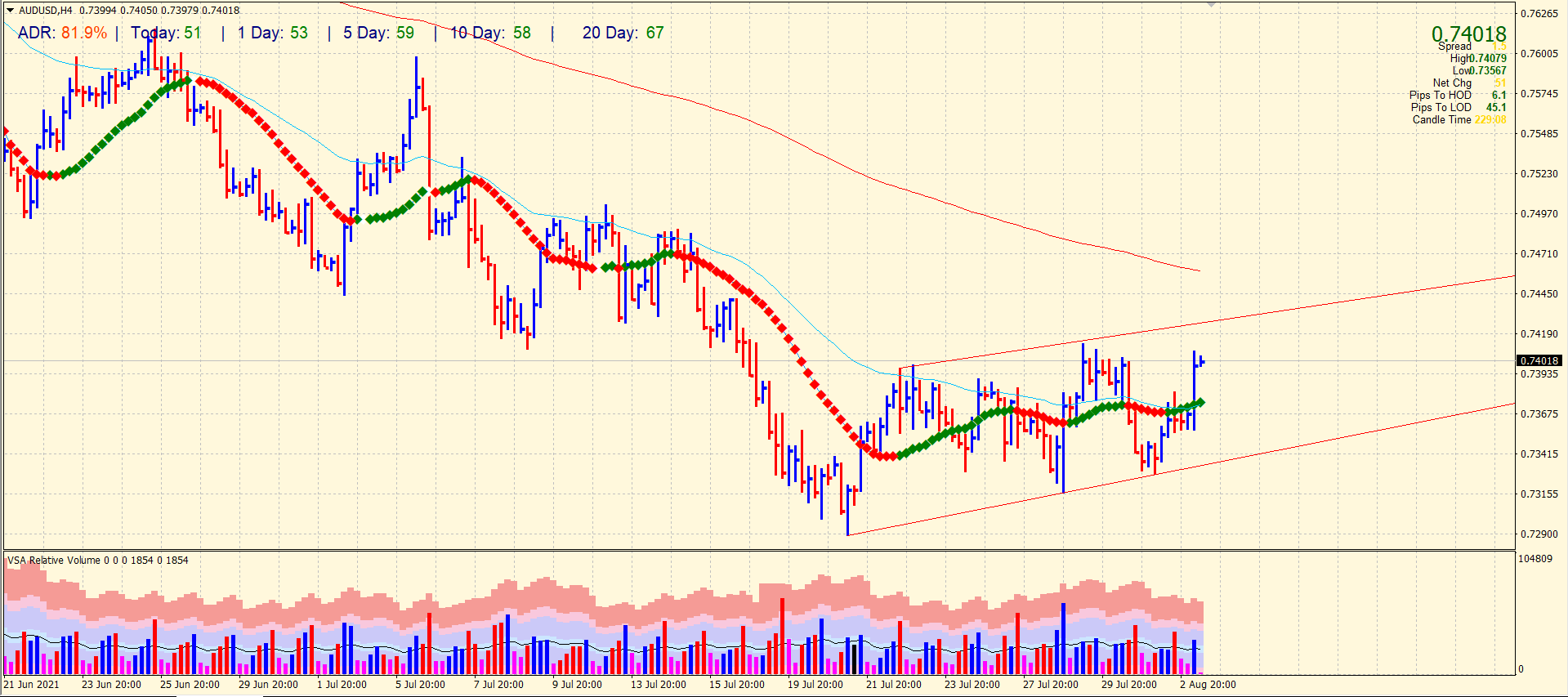

AUD/USD price technical analysis: Key levels to watch

The AUD/USD pair has successfully broken above the congestion of 20 and 50 period SMAs. The price is heading higher towards the upper trendline of the bullish trend channel on the 4-hour chart. The upper boundary of the trend channel can cap further gains for now. However, if broken, the price may surge towards 200-period SMA at 0.7460. On the flip side, the price may see a fall towards the congestion of 20 and 50 period SMAs at 0.7370, which may act as a support now. The volume bars show a sign of bullish reversal. We may see more gains on the day. However, the price has already 81% of the average daily range.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.