- AUD/USD posted one-month highs and retreated slightly from there.

- The labor force participation fell in September; the figures may weigh on the Aussie.

- Market participants await PPI and jobless claims data from the US today to find fresh impetus.

The AUD/USD price lost some gains from a one-month high of around 0.7394 in Asia and recently trading neutral around 0.7385.

-If you are interested in automated forex trading, check our detailed guide-

The AUD/USD pair relied on a positive move in the US consumer price index the previous day and accelerated at the start of Thursday’s trading session. Due to the recent momentum, the AUD/USD has risen to its highest level since Sep 10, although it was not lagging behind and stopped just above the 0.7400 level.

The Australian dollar was impacted by various domestic data, which showed the labor force fell by 138k in September. This is due to a decrease of 146.3k last month, and the unemployment rate rose slightly to 4.6 percent from 4.5 percent in August.

In addition, the weaker Chinese consumer price index (CPI), which rose 0.7% annually, continued to hold back progress by the Chinese agent, the Aussie, as the US dollar rebounded on average. However, the generally positive tone of equity markets has added some support for perceived currencies as risky and has helped halt the decline.

Therefore, it is wise to wait for a strong follow-up sell before confirming that the recent surge has lost momentum in the past two weeks. Market participants are now looking forward to the US economic docket that publishes weekly jobless claims and PPI numbers.

If you are interested in guaranteed stop-loss forex brokers, check our detailed guide-

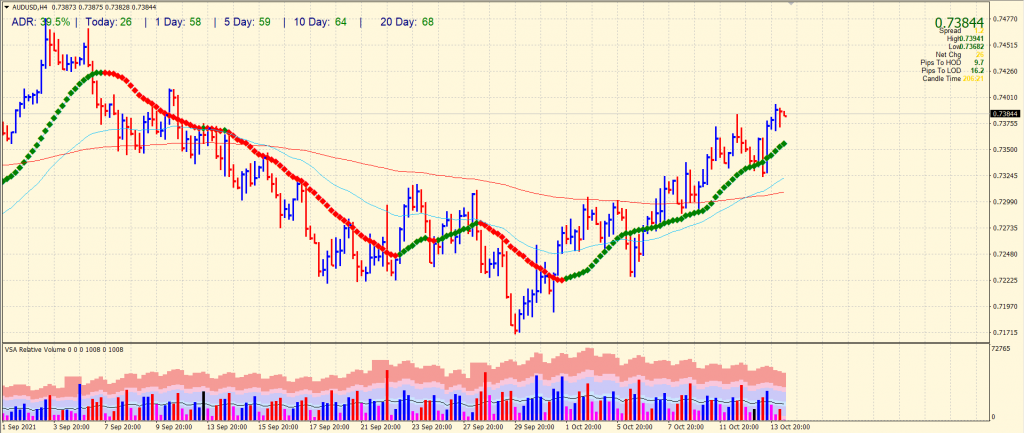

AUD/USD price technical analysis: Neutral near highs

The AUD/USD price remains stagnant near the critical resistance area of 0.7400. The pair remains well bid above the 20-period SMA on the 4-hour chart. The average daily range is 39% so far, which indicates potential volatility in the market today. Any upside attempt will face a hurdle at 0.7400 handle ahead of 0.7409 (swing high of Sep 09). On the flip side, 0.7350 will act as temporary support ahead of the 0.7300 handle. The volume figures do not show any trendy move at the moment.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.