- AUD/USD maintains a bullish outlook above 0.7300.

- The risk-sensitive Aussie is poised to rise benefiting from Powell’s comments.

- The upbeat companies’ profit helps the pair to rise.

The AUD/USD price analysis reveals a bullish scenario despite rising in Covid cases. Thanks to the Powell led losses in Greenback.

The AUD/USD pair is trading at 0.7302, down 0.12% at the time of writing on Monday.

–Are you interested to learn more about ECN brokers? Check our detailed guide-

Australia’s risk-sensitive currency is expected to rise against the US dollar as Monday’s Asia-Pacific session gets underway. The dollar hasn’t changed in comparison to its competitors. Trading in Asia-Pacific can benefit from Jerome Powell’s remarks at the Jackson Hole economic symposium on Friday. Although Powell’s post suggests that QE’s asset purchases may contract this year, he doesn’t provide a clear timeline. The September meeting of the FOMC will likely convey this message.

AUD/USD consolidates at weekly highs above 0.7300 after operating income for Australian companies reached 7.1% in the second quarter. However, thanks to Fed Chairman Powell’s tenacious remarks last Friday, the Aussie is oblivious to the rise in Covid cases amid a weaker US dollar. Instead, the second-quarter GDP of Australia is in the spotlight.

A better economic outlook may be influencing the falling yields of government bonds on Friday, but they remained higher throughout the week. In addition, Wall Street shares closed higher by the end of the week, with defensive stocks rallying. According to Federal Reserve Chairman Ben Bernanke, the United States has made significant progress in fulfilling its dual mandate and has already met its inflation target. Powell stressed, however, that raising interest rates would have to meet higher economic progress standards. Nevertheless, it should lead to some upside for the stocks.

There are alarming numbers of cases in New South Wales (NSW), Australia’s worst-hit state. On Sunday, 1,218 new local cases were reported in the state, which includes Sydney. Josh Friedenberg, Australia’s treasurer, warned that job losses and company shutdowns will result if state borders remain closed. However, this suggests that state leaders are sticking to the national plan. Vaccination rates in Australia must reach 70-80% before sweeping bans are lifted.

There are relatively few economic data releases today outside of Australia, and Japan’s wholesale and retail sales figures are the only ones scheduled for release in Thailand. China’s manufacturing PMI data will be watched closely by traders in the Asia-Pacific region on Wednesday. Analysts anticipate a slowdown in manufacturing activity. The main event of the week will be the nonfarm payroll report for the United States.

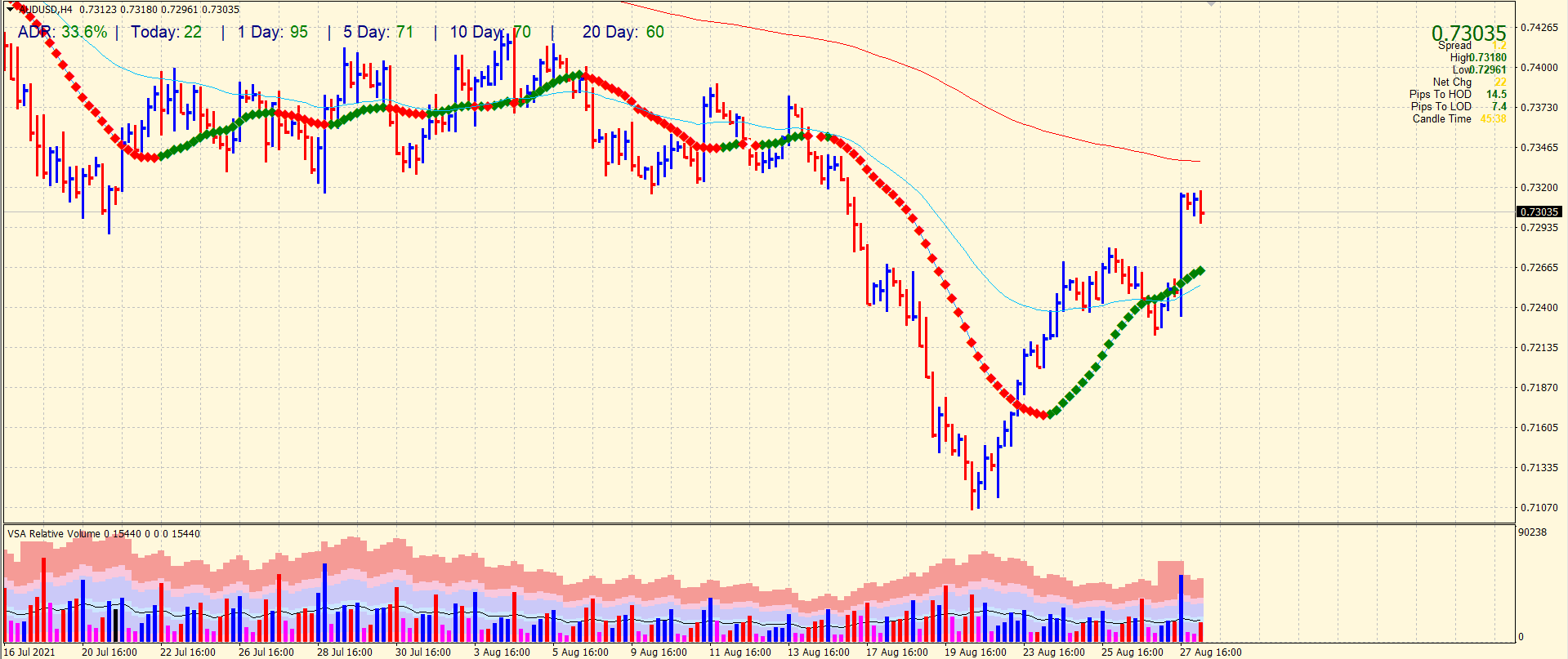

AUD/USD price technical analysis: 0.7300 support protecting the gains

The AUD/USD pair remains well bid above the key moving averages. However, the price is still below the 200-period moving average on the 4-hour chart. Therefore, the level at 0.7330 may cap the gains for now. However, the downside remains limited as the 100-period SMA at 0.7280 may protect the gains.

–Are you interested to learn more about making money in forex? Check our detailed guide-

Meanwhile, ultra-high volume on Friday suggests there could be some retracement of the uptrend before continuing a higher move. The average daily range is at 33%. So, the pair is ripe to move on either side.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.