- Monday marked the second straight day of gains for the AUD/USD pair.

- A positive tone in the equity markets favored the riskier Australian dollar.

- Fed’s hawkish expectations and higher US bond yields supported the dollar and limited its growth.

The AUD/USD price held its gains ahead of the European session, most recently hovering around the daily high of 0.7200.

–Are you interested to learn more about AI trading brokers? Check our detailed guide-

On the first day of a new week of trading, the pair built on Friday’s rebound from the 0.7130 area or more than a 2-week low. It was the second consecutive day of earnings, fueled by the generally positive sentiment in the equity markets, which typically favors riskier Australian companies. However, at least for now, the bulls have been hampered by the resurgence in demand for the US dollar, which has limited their ability to bet aggressively.

US Treasury yields rose on Monday amid expectations of faster Fed policy tightening, boosting confidence in the US dollar. Despite a disappointing NFP headline, the US unemployment rate fell more than expected, and wages grew faster. The data confirmed market expectations of a Fed rally in March 2022, which in turn boosted US bond yields and helped restore demand for dollars.

Fundamentals favor dollar bulls, and caution is needed before anticipating further appreciation in the AUD/USD pair. Additionally, investors may be hesitant to bet aggressively and prefer to wait for a new catalyst from Wednesday’s consumer inflation data. Finally, traders will also pay attention to the testimony of Fed Chairman Jerome Powell on Tuesday and monthly US retail sales on Friday.

Meanwhile, US bond yields will continue to influence dollar price dynamics and add momentum to the AUD/USD pair. Combined with broader market risk sentiment, this should allow traders to take advantage of some short-term opportunities.

–Are you interested to learn more about Canada forex brokers? Check our detailed guide-

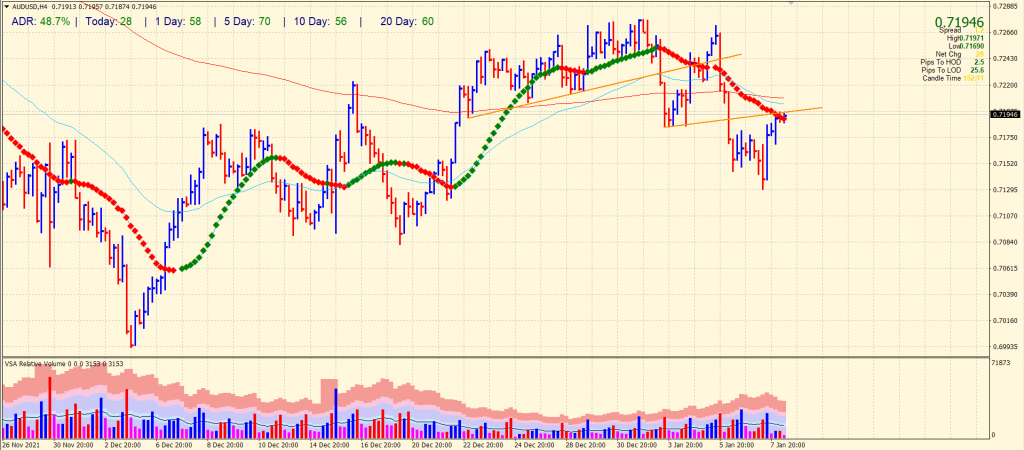

AUD/USD price technical analysis: Bulls emerging

The AUD/USD bulls are just shy of 0.7200, while the rally may find resistance by the 20-period SMA (4-hour chart) and the broken minor trendline. The volume data shows signs of bullish reversal while the average daily range is 48% so far, which is quite higher than usual. It shows potential volatility for the day. On the upside, 0.7250 and 0.7280 will be the key resistance levels.

On the flip side, 0.7150 and 0.7100 will be the key support levels to watch. Meanwhile, more bearish volume can breach the 0.7100 handle as well.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.