- The AUD/USD faces hurdles near 0.7200 amid rising Russian and Ukrainian concerns.

- Investors will be on their toes by the statements from the UN emergency meeting.

- Markets in Asia are in a bloodbath as the geopolitical situation worsens.

The AUD/USD price rose from Tuesday’s low at 0.7170. Still, it hit a wall around 0.7200 after a United Nations (UN) emergency meeting added to the uncertainty in an already highly volatile market. In addition, risk-sensitive counterparts have been pressured by risk-escalating geopolitical tensions between Russia and Ukraine.

–Are you interested in learning more about STP brokers? Check our detailed guide-

In an emergency meeting of the UN Security Council, the Russian ambassador said: “We will not allow another bloodbath in Donbas.” Meanwhile, Ukraine is unconvinced and reiterates that “its border will remain unchanged regardless of Russia’s statements.”

Until then, there will be no principled result from an emergency UN meeting; risk-sensitive assets will remain vulnerable.

As a result, the Australian dollar dropped against the US dollar due to Christopher Kent’s speech to the Reserve Bank of Australia (RBA) on Tuesday.

Amid increasing expectations of imminent strikes between Russia and Ukraine, Australia has withdrawn its diplomats from Ukraine. In addition, the Australian government has asked Australians to leave the country.

The US Dollar Index (DXY) trades comfortably above 96.00, near 96.20. Market volatility has reduced investor risk appetite, driving the DXY higher.

Russian-Ukrainian headlines will continue to influence the AUD/USD. Markit will closely monitor Tuesday’s data on consumer confidence and PMI in the US. In addition, the Australian Register will report quarterly and annual Wage Price Index (WPI) data on Wednesday.

AUD/USD price technical analysis: Bears gaining strength

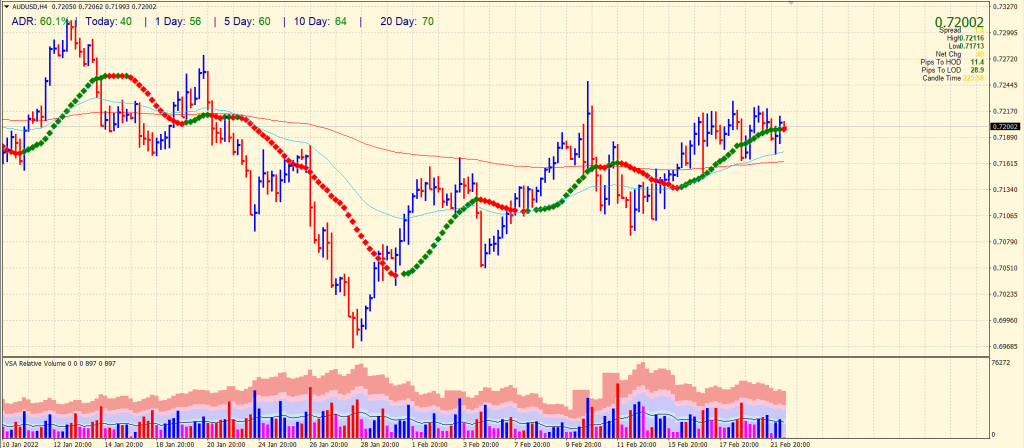

The AUD/USD price has remained in consolidation since Feb 16. The pair is wobbling above the 20-period SMA on the 4-hour chart. Meanwhile, the bullish crossover between 50-period and 200-period SMAs provides mild support to the pair. However, the outlook is losing positivity just around 0.7200 area.

–Are you interested in learning more about forex robots? Check our detailed guide-

The upside path beyond 0.7200 is full of hurdles that may restrain the rise of Aussie. However, the volume is rising with the price rise. But the overall scenario remains neutral. The pair has marked a 60% average daily range so far, which shows that the price may remain volatile today.

The confluence of 50 and 200 SMAs in the 0.7160-70 zone may support, but the breakout will trigger a sharp move towards 0.7100 and 0.7050. Again, bears are likely to dominate in the absence of bulls.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money