- AUD/USD remains on the backfoot as RBA keeps the policy rate and asset purchase unchanged.

- Chinese real estate sector faces more downturn after Evergrande.

- Covid cases rise in Australia, weighing further on the Aussie.

The AUD/USD price declined to an intraday low of 0.7255, 0.26% down the day after initial inaction following the Reserve Bank of Australia’s (RBA) policy announcement early Tuesday morning. While the RBA left its key rate at 0.10% and its weekly bond purchases at $ 4.00 billion unchanged.

-Are you looking for the best CFD broker? Check our detailed guide-

Despite the increasing trade balance, Australia’s imports and exports declined in August. In September, ANZ Job Advertising announced a -2.7% decrease in employment, which fell below the previous forecast.

In addition to cautious optimism from the RBA and mixed data released in Asia, AUD/USD is tracking sluggish market sentiment and remains depressed due to the risk barometer status.

Even though global markets have not recovered from Evergrande default fears, the list of Chinese real estate firms that have messed up financial stocks is long. Fantasia Holdings Group defaulted on its debt earlier in the day, according to Bloomberg. Sinic, a Beijing-based real estate developer, has been downgraded by global rating agency Fitch since then.

In addition, US President Joe Biden’s willingness to reduce Democratic demands for infrastructure spending initially boosted market sentiment in Asia. In recent times, however, investors have been reluctant to take risks over fears of Republican opposition. Moreover, as Biden previously noted, Republicans were to blame for the fact that a deal had not been reached by the October 18 deadline.

Moreover, the increase in COVID infections in Australia to the highest level since September 30, 2406 at the latest, is also weighing on AUD/USD prices.

A new Japanese prime minister has hinted that he will join the United States to curb China’s power grab in Taiwan, dampening risk mode and calling into question AUD/USD prices.

The implicit moves in US stock futures and Treasury bond yields show a lack of market confidence in the near term. Nonetheless, the US Dollar Index (DXY) rises to 94.00, creating pressure for commodities as well as antipodes.

The short-term direction of AUD/USD will be influenced by risk catalysts after the initial reaction to the RBA’s decision. The policies of China and the United States deserve particular attention. Also important for clarity are the final Markit PMI for September and the ISM manufacturing PMI for the US.

-Are you looking for forex robots? Check our detailed guide-

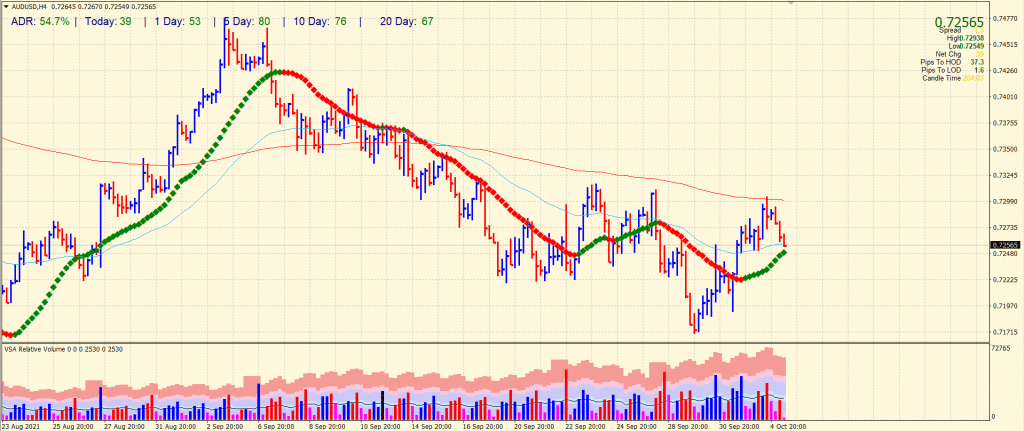

AUD/USD price technical analysis: Price capped by 200-SMA

The AUD/USD price remains well above the 20-period SMA on the 4-hour chart. Moreover, the 50-period SMA is also supporting the price. Both the SMAs are in the process of making a bullish crossover. However, the price remains capped by the 200-period SMA. The pair has so far covered the 48% average daily range. The volume data is not clearly bullish or bearish at the moment. Hence, the price is expected to wobble between 0.7200 and 0.7300.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.