- As AUD/USD accepts an offer to update the intraday low, it pulls back from a 1.5-month high.

- In the midst of uncertainty over the next move, the RBA rate hike did not impress bulls.

- The tense US-China relationship and fears about the economy’s slowdown put downward pressure on prices due to risk aversion.

The AUD/USD price continues to decline from a one-month high following RBA’s rate decision during Tuesday’s earlier European session. As of press time, the Aussie is taking offers to hit fresh daily lows around 0.6930.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

As expected, the RBA announced a 50 basis point (bp) rate hike, the fourth in 2022, while raising interest rates to 1.85%. AUDUSD has been weakened by the RBA’s announcement that the central bank is not following its mandated rate normalization path.

While market sentiment and AUD/USD rates appear to be impacted by reports of a US-China dispute over the visit of US Secretary of the Interior Nancy Pelosi to Taiwan. Similarly, the Dragon Nation’s readiness for military exercises in Bohai in the South China Sea could be considered.

Risk aversion and price declines are also fueled by headlines suggesting uncertainty among Chinese politicians over GDP forecasts.

Meanwhile, the latest US and European PMI data suggest sluggish economic growth, which weighs on market sentiment and favors sellers of AUD/USD. Direct signals from Fed Chair Jerome Powell that the hawks are losing steam could also dispel doubts.

Stock futures in the Asia Pacific and the US are showing losses, showing sentiment. In spite of the US dollar weakness, the US 10-year coupon is down 5.5 basis points (bps) to 2.55%. Before recovering from 105.00, the US Dollar Index (DXY) touched a monthly low.

The RBA rate statement and US July jobs data are expected to keep AUD/USD traders entertained ahead of Friday’s Fedspeak and China headlines.

AUD/USD price technical analysis: Bears eying YTD lows

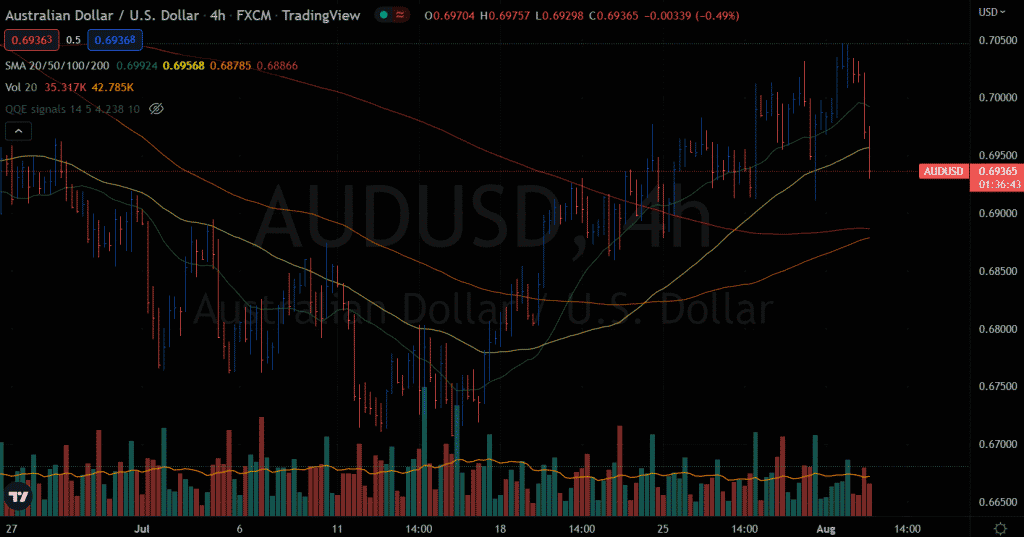

The 4-hour AUD/USD price chart shows a dismal scenario for the pair. The price has seen a widespread down bar with a very high volume. Moreover, the key SMAs are also lying above the price. It indicates the probability of further downside correction. The bearish dominance may push the price towards the yearly lows below the 0.6700 handle.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

Conversely, any upside recovery will remain confined around 100-period and 20-period SMAs. Further upside may test the 0.7000 psychological level.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.