- A new intraday high for the AUD/USD pair has broken the two-day downtrend.

- Turkey and Venezuela would rather take risks; Australia’s Prime Minister declares a state of emergency due to flooding in New South Wales.

- Additionally, China’s inflation and the RBA’s low rates contribute to the bullish trend.

- RBA’s Debel should back Lowe’s cautious optimism to keep buyers hopeful. The news from Ukraine is also important.

Before Wednesday’s European session, the AUD/USD price reflects cautious market optimism despite bearish domestic catalysts. The Australian pair is up 0.15% to 0.7280 at press time, it’s first daily gain in three days.

–Are you interested in learning more about copy trading platforms? Check our detailed guide-

Market optimism

Taking Ukraine out of NATO and confirming the first humanitarian corridor in Kyiv are key catalysts for challenging the old anti-risk mindset. In addition, the release of an American prisoner by Venezuela and the indication of later ease in sanctions are also positive for risk sentiment and the AUD/USD price due to the country’s status as a risk barometer.

In the meantime, uncertainty over Kyiv’s plans to join the European Union (EU) and Russian moves to nationalize foreign factories is questioning market sentiment and testing AUD/USD bulls.

In the same vein, Australian media outlet ABC News could be reporting: “Prime Minister Scott Morrison has declared a national emergency because of catastrophic flooding in New South Wales.”

Against this backdrop, the US 10-year Treasury yield falls two basis points (bps) to 1.85%, while the S&P 500 futures remain flat.

Key data for the AUD/USD price

In addition to the AUD/USD pair’s recent recovery, optimistic Chinese inflation data and less optimistic comments from RBA chief Philip Lowe also contributed to the rise.

Nevertheless, buyers will be watching for risk catalysts and the comments of RBA Deputy Governor Guy Debel, due around 0800 GMT.

AUD/USD will have another reason to rise if Debel follows Low’s willingness to hike rates this year.

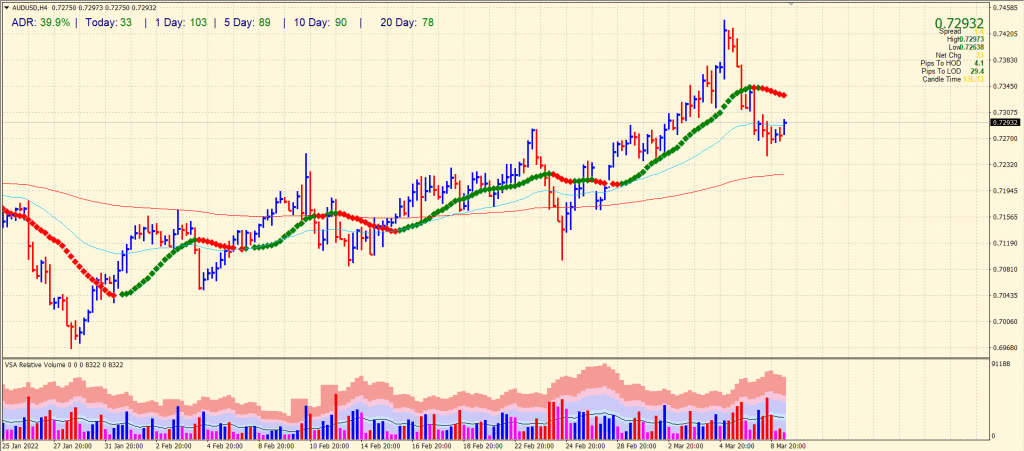

AUD/USD price technical analysis: Shallow recovery

The AUD/USD price found little support below mid-0.7200, and now the pair has moved beyond the 50-period SMA on the 4-hour chart. Although the move is feeble, the pair may find stiff resistance at 0.7300 area. The volume for the upside recovery is declining, while the volume for downside was high with a widespread bar. The 20-period SMA around 0.7325 may also be a strong hurdle ahead of 0.7350.

–Are you interested in learning more about scalping forex brokers? Check our detailed guide-

On the flip side, any subsequent fall may find support around 0.7250 ahead of 0.7200. We also expect consolidation around the 0.7300 area before any directional move.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money