- AUD/USD remains lower on the day.

- Australian employment data came up with mixed numbers.

- Pandemic fears are also keeping the economic recovery stalled.

The AUD/USD price hovers around intraday lows of 0.7467 after a daily low of 0.12%, following vague signals from Australia’s June employment report released early morning on Thursday. The reason for this could be the weakening of market sentiment and the recovery of the US Dollar.

-Are you looking for automated trading? Check our detailed guide-

The overall change in employment in Australia fell below the expected 30.0k and 115.2k compared to 29.1k in June, while the employment rate remained unchanged at 66.2% compared to the forecast of 66.3%. In contrast, unemployment fell to 4.9% that month, contrary to the market consensus of 5.5% and the previous 5.1%. Earlier in the day, Australian consumer inflation expectations for July were in line with projections of 3.7%, down from 4.0% earlier.

In addition to the mixed employment figures, the bad mood in the markets is also weighing on some risk barometers. Behind risk aversion, is worries about coronavirus (COVID-19) stress and fear of reflation.

In a biennial statement, Fed Chairman Jerome Powell tried to convince markets that the Federal Reserve will make many announcements before adjusting the monetary policy. However, the strong US producer price index (PPI), which preceded the bullish consumer price index (CPI), made traders ignore Powell’s comments.

On the flip side, worsening Covid conditions in Australia are becoming a major concern for AUD/USD traders due to delays in vaccine distribution. Australian Prime Minister Scott Morrison recently told ABC News that the vaccine hit the market two months ago. Likewise, World Bank Group President David Malpass said, according to Reuters, “A shortage of vaccines means many countries in East Asia and the Pacific may not have their populations fully vaccinated by 2024, even as new strains hit the market.”

-If you are interested in forex day trading then have a read of our guide to getting started-

Given the initial market reaction to the Australian employment report, AUD/USD traders will point out new momentum on the decline in China’s June data and GDP for the second quarter. However, risk catalysts tend to hold the driver’s seat.

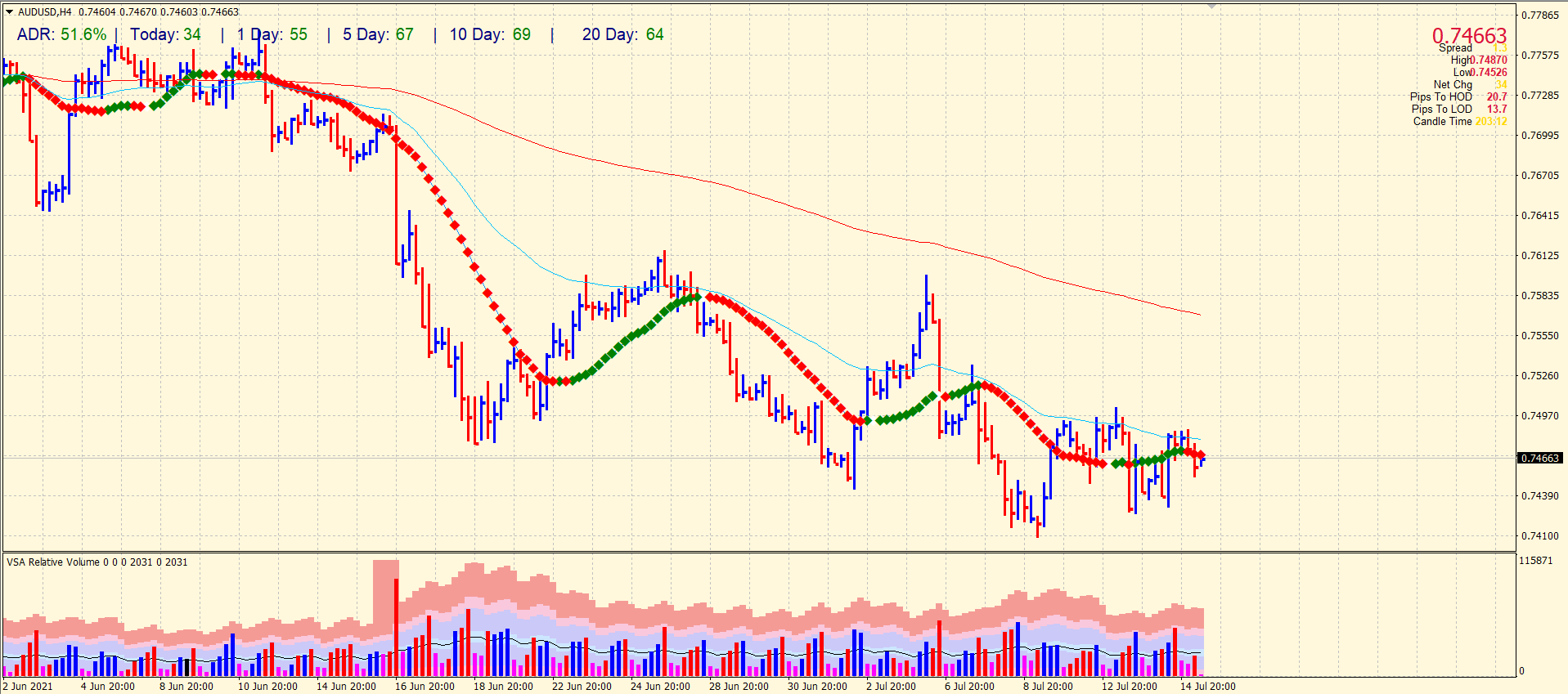

AUD/USD price technical analysis: Key moving averages to watch

The gains in AUD/USD price remains capped by the 20 and 50 periods SMAs on the 4-hour chart. Moreover, we can see a down bar with very high volume closing in the mid with a relatively smaller spread. This indicates selling pressure in the market. However, the pressure can be alleviated if we see a breakout of key moving averages.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.