- Early-session bump on NZ business confidence sees the Aussie getting dragged higher alongside.

- Broader markets are entirely focused on the upcoming US FOMC rate hike.

The AUD/USD has been trapped under the 0.7300 handle, unable to venture further north of 0.7250 as the pair runs into the outer wall of a descending triangle, and a thin economic schedule leaves the Aussie-Dollar fully exposed to the upcoming US Fed rate call. Early Wednesday is seeing a brief pop in the Antipodeans thanks to a better-than-expected reading for New Zealand’s business confidence, and the knock-on proximity of the two countries is providing the AUD with a mild boost in an otherwise thin day.

The economic calendar sees little meaningful data for the AUD this week, and broader markets are turning their attention to Wednesday’s US Fed showing, where markets are forecasting another 0.25% interest rate hike from the FOMC, and investors will be looking for the Fed’s updated dot plot on upcoming rate hikes in the future.

Sentiment within Australia remains a tepid affair, with the Reserve Bank of Australia (RBA) firmly entrenched in a wait-and-see mode that has stretched on for over two years, while the Aussie’s domestic economy continues to middle, despite some fringe signs of growth, all of which remains contingent on trade both with and outside of China remaining a positive flag, and with the steepening US-China trade war bulls are having a hard time pushing the buy buttons.

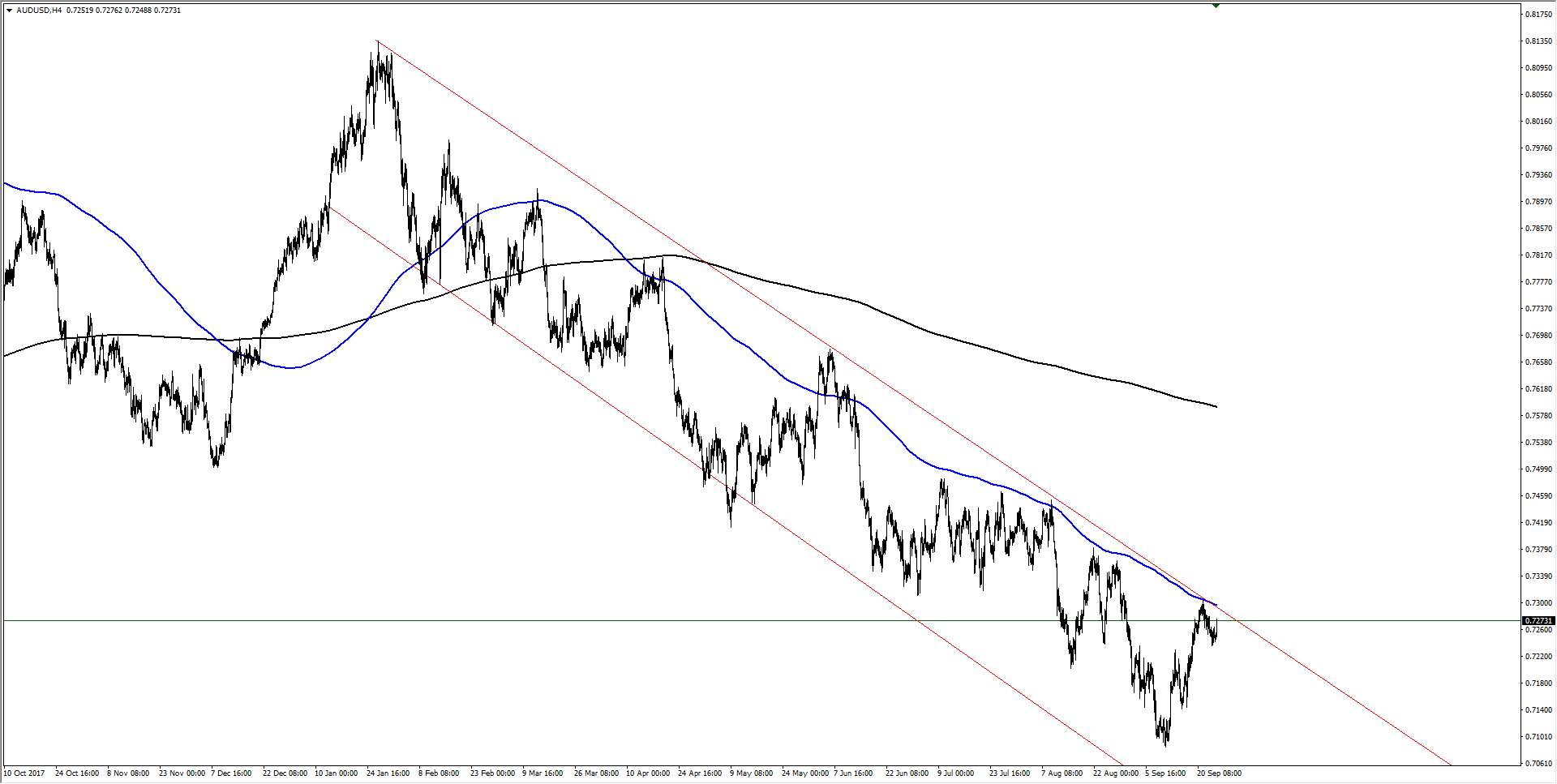

AUD/USD Technical Analysis

The Aussie has remained locked in a firm downtrend for 2018, and the major pair’s latest peak just beneath the critical 0.7300 level leaves the long-term chart with another lower high, a pattern that has remained unbroken for nine months. Although the Aussie managed to close in the green for two consecutive weeks against the US Dollar recently, this had more to do with a broad-market sell-off in the Greenback than it did any particular reasons to buy the Aussie, and after the Daily candles dropped a spinning top signal on last Friday’s market close, bears will be looking to jump into any confirmable sell-side signals, depending on how the upcoming FOMC rate call drops.

AUD/USD Chart, 4-Hour

| Spot rate | 0.7273 |

| Current week change | 0.18% |

| Previous week high | 0.7304 |

| Previous week low | 0.7141 |

| Support 1 | 0.7233 (200-hour SMA) |

| Support 2 | 0.7141 (previous week low) |

| Support 3 | 0.7085 (major 2018 technical bottom) |

| Resistance 1 | 0.7289 (50-day EMA) |

| Resistance 2 | 0.7304 (four-week high) |

| Resistance 3 | 0.7590 (200-day SMA) |