“¢ Resurfacing US-China trade war fears/a modest USD uptick prompts some selling on Wednesday.

“¢ Disappointing US ISM manufacturing PMI offsets stronger ADP report and helps limit further slide.

“¢ Investors focus remains glued to the latest FOMC monetary policy decision, due later today.

The AUD/USD pair maintained its offered tone through the early North-American session, albeit has managed to defend the 0.7400 handle, at least for the time being.

The pair snapped three consecutive days of the winning streak and came under some fresh selling pressure on Wednesday. Against the backdrop of a follow-through US Dollar buying interest, renewed US-China trade war fears exerted some additional downward pressure on the China-proxy Australian Dollar.

The selling bias picked up pace following the release of today’s stronger ADP report, showing that private sector employment increased by 219K jobs. This coupled with the ongoing surge in the US Treasury bond yields provided a minor boost to the greenback and further collaborated to the pair’s latest leg of downtick, seen over the past couple of hours.

Meanwhile, the disappointing release of US ISM manufacturing PMI, falling to the weakest level of 2018 in July (58.1), extended some support and helped the pair to bounce off the 0.7400 neighborhood. It, however, remains to be seen if the pair continues defending the mentioned handle as investors start repositioning for today’s key event risk – the latest FOMC monetary policy decision, due to be announced during the New-York trading session.

Technical Analysis

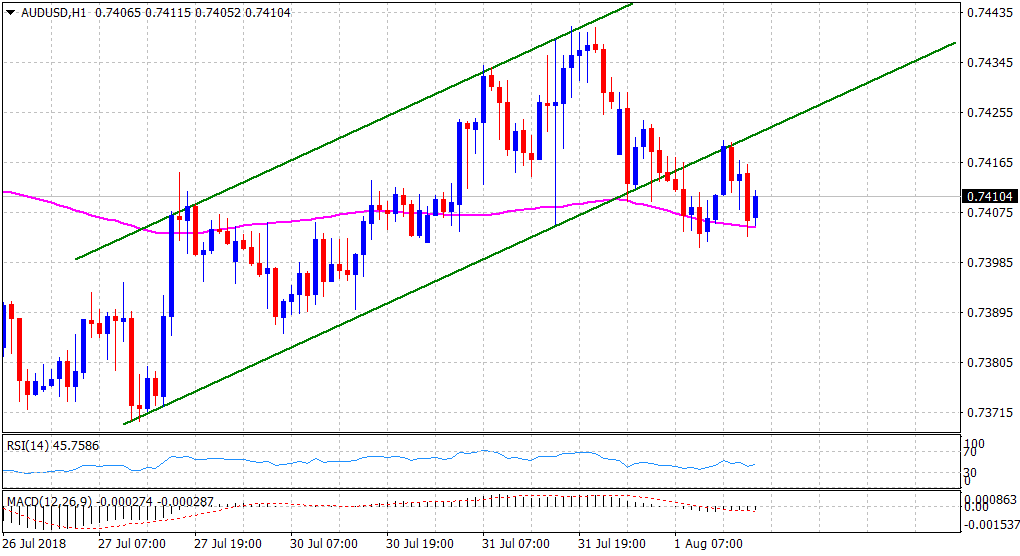

The pair has already broken below a short-term descending trend-channel on the 1-hourly chart but now seems to be finding some support near 100-hour SMA.

Hence, it would be prudent to wait for a follow-through weakness below the said moving average before confirming the bearish breakdown and positioning for any further near-term downfall.

However, a sustained move back above the 0.7440 region would be enough to negate the bearish outlook and might trigger a near-term short-covering move towards the key 0.7500 psychological mark.