- The Aussie is breaking into a fresh 20-month low as the US Dollar resumes its climb.

- Aussie data due for Wednesday is unlikely to see much action as traders await Thursday’s Australian employment numbers.

The AUD/USD pairing is trading into 0.7240 after bottoming out at a new 20-month low of 0.7223 on Tuesday as the US Dollar resumed its march up the charts across the broader FX space.

Aussie traders are looking up from the bottom of a steep slide as Wednesday sees another round of the Westpac Consumer Confidence survey, due early at 00:30 GMT. Consumer confidence last clocked in at 3.9%, while the q/q Wage Price Index, dropping at 01:30 GMT, is forecast to print at 0.6%, slightly above the previous reading of 0.5%.

AUD bulls are unlikely to be moved by Wednesday’s economic data as they await Thursday’s showing of the Australian jobs report, where the seasonally-adjusted Unemployment rate is forecast to move from 5.4% to 5.5%, while the Participation Rate is seen declining slightly from 65.7% to 65.6%.

With a middling economy and sluggish growth metrics, little intrinsic momentum is found for the AUD as the interest divergence between the Aussie and the Greenback continues to widen, and the Aussie finds itself at the mercy of broader market sentiment which has turned increasingly pro-Dollar and the AUD is on pace to close lower against the USD for a sixth month out of the last seven.

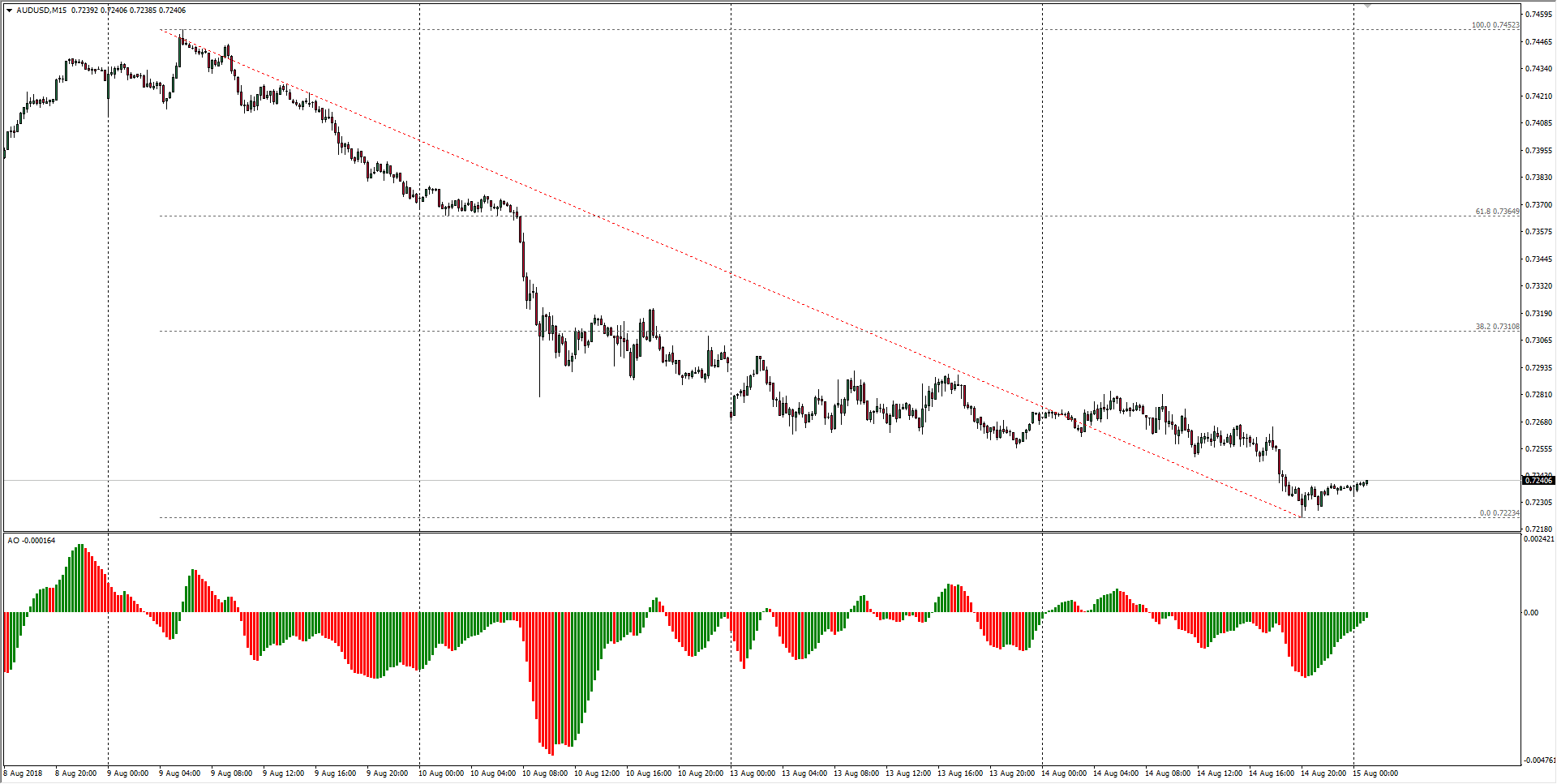

AUD/USD Technical Analysis

The Aussie is looking primed for a bullish correction sagging into range of setting a two-year low with technical indicators buried firmly into oversold territory, but falling knives threaten most hands as Aussie traders await a meaningful trigger to begin piling back into the AUD.

AUD/USD Chart, 15-Minute

| Spot rate: | 0.7240 |

| Relative change: | Negligible |

| High: | 0.7240 |

| Low: | 0.7234 |

| Trend: | Bearish |

| Support 1: | 0.7234 (current day low) |

| Support 2: | 0.7223 (current week low; major technical bottom) |

| Support 3: | 0.7117 (S2 weekly pivot) |

| Resistance 1: | 0.7292 (currrent week high) |

| Resistance 2: | 0.7365 (61.8% Fibo retracement level) |

| Resistance 3: | 0.7452 (previous week high) |