- The Aussie sees some upside on positive Retail Sales figures.

- It’s another US NFP Friday and the US DOllar will be driving markets.

The AUD/USD is trading into 0.7375, seeing a mild recovery from recent lows after a better-than-expected showing for Aussie Retail Sales.

Australia’s Retail Sales figures for June came in at 0.4%, not an overly impressive figure, and hanging onto the previous period’s reading, though the release did beat market forecasts of 0.3%. The AUD/USD ticked into recent lows this week after Aussie trade balance figures showed lopsided declines in imports and exports, but the improved Retail Sales figures from early Friday are helping give the Aussie a last-minute leg up before the US Non-Farm Payrolls jobs report drops on markets at 12:30 GMT.

The Aussie has been trapped in rough consolidation for much of July’s trading, and the pair is heading into August’s action resuming the trend, though a strong pop for the Greenback on the upcoming US NFP report could see the Aussie dipping into new lows for 2018.

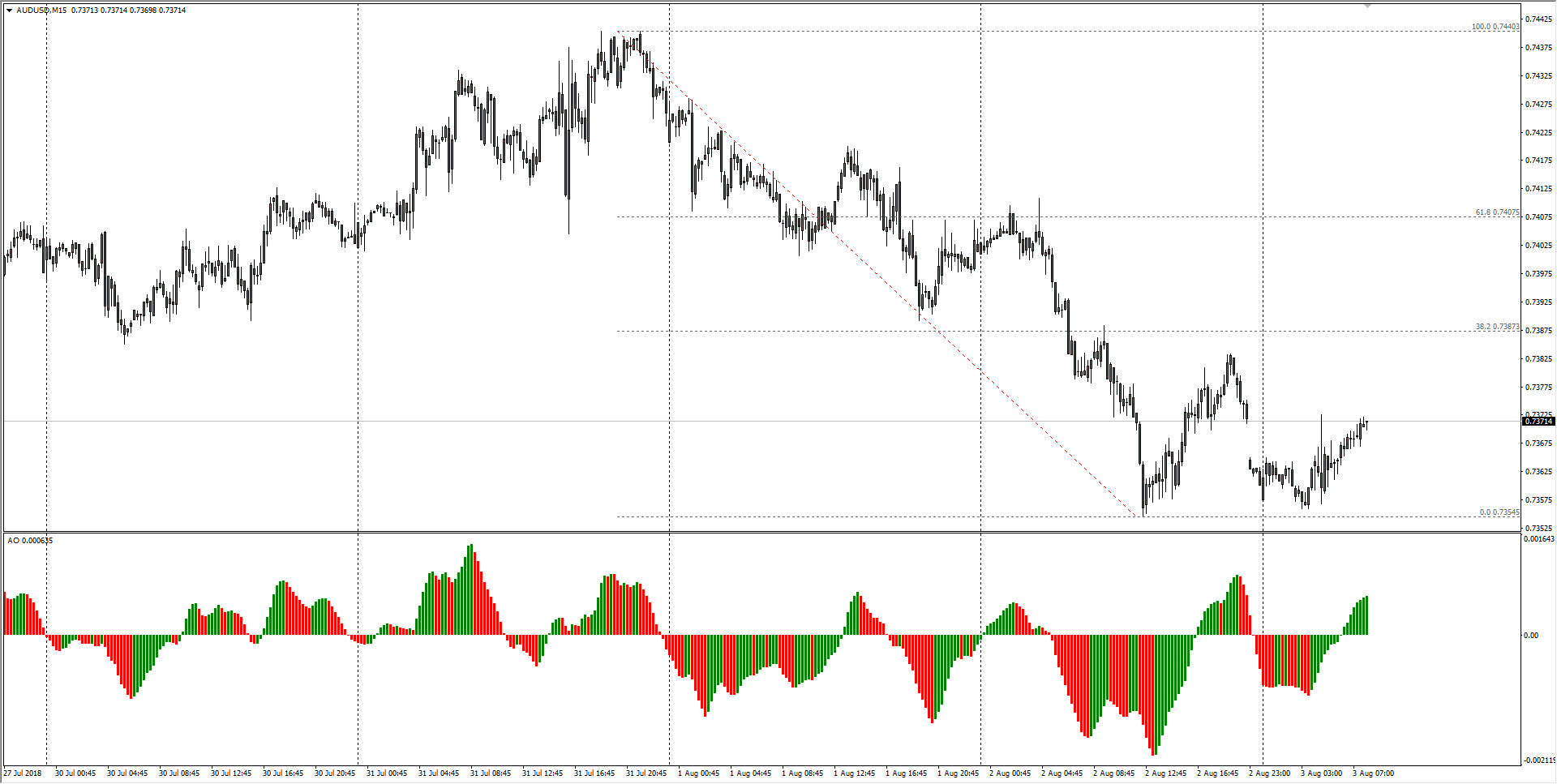

AUD/USD Technical Analysis

- The Aussie is seeing a brief pick-up off of recent lows near 0.7350, but with traders looking towards the US NFP report market action to cap off the week rests firmly in the hands of Greenback traders, though further downside still requires Aussie shorts to break through the lower end of July’s consolidation range.

AUD/USD Chart, 15-Minute

| Spot rate: | 0.7371 |

| Relative change: | 0.19% |

| High: | 0.7372 |

| Low: | 0.7356 |

| Trend: | Bearish |

| Support 1: | 0.7354 (current week low) |

| Support 2: | 0.7317 (four-week low) |

| Support 3: | 0.7280 (S3 daily pivot) |

| Resistance 1: | 0.7387 (38.2% Fibo retracement level) |

| Resistance 2: | 0.7440 (current week high) |

| Resistance 3: | 0.7463 (July 25th swing high) |