“¢ Weaker commodity prices prompt some fresh selling on Monday.

“¢ A subdued USD price action helps limit deeper losses, for now.

The AUD/USD pair struggled to build on Friday’s goodish rebound and traded with a mild negative bias at the start of a new week.

The pair met with some fresh supply on Monday and was being weighed down by weaker commodity prices, especially copper, which tends to undermine demand for commodity-linked currencies – like the Aussie.

However, a subdued US Dollar price action, as investors digest Friday’s stronger, but not very impressive, US Q2 GDP growth figures, helped limit further downside, at least for the time being.

The pair now seemed struggling to make it through back above the 0.7400 handle, with the continuous US-China trade tensions further collaborating towards keeping a lid on any meaningful up-move for the major.

Technical Analysis

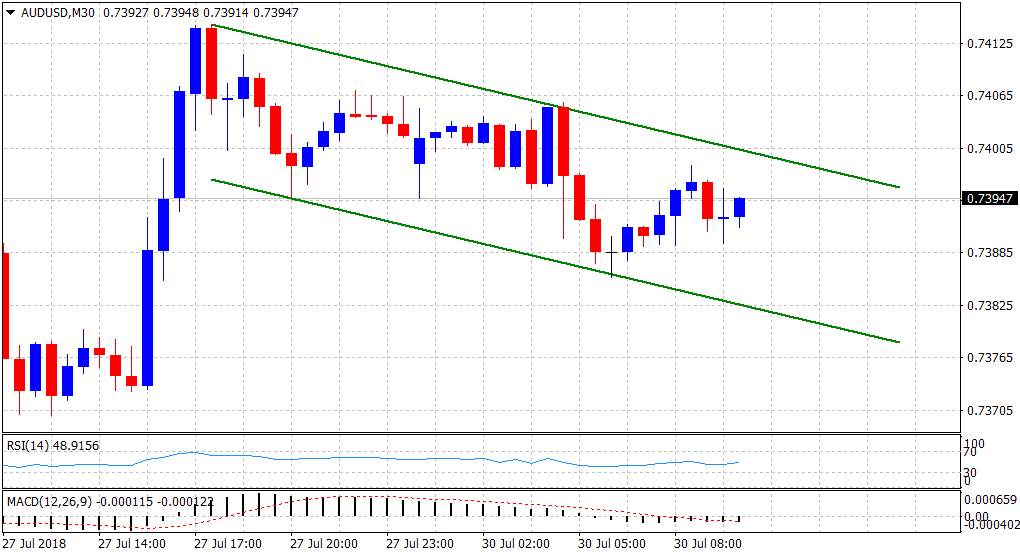

Looking at the technical picture, the pair has been drifting lower alongside a descending trend-channel formation on the shorter timeframe. This coupled with the fact that it remains below important moving averages on the hourly chart (50, 100 & 200-period SMAs) further reinforce the bearish bias.

Hence, any attempted up-move might now be seen as an opportunity to initiate intraday bearish positions amid absent fundamental drivers, in terms of any major market moving economic releases from the US.

However, a sustained move beyond the 0.7400 handle, also coinciding with the trend-channel resistance, might negate the bearish bias and trigger a near-term short-covering bounce back towards 0.7455-65 heavy supply zone.

Alternatively, a convincing break below the trend-channel support, currently near the 0.7380 area, is likely to accelerate the fall towards mid-0.7300s before the pair eventually drops to retest YTD lows, around the 0.7310 region.