- Aussie slips on trade headlines, regains footing after improved West Survey reading.

- Further tariffs to be announced between the US and China as trade war concerns resurface through the broader market.

The AUD/USD is catching some minor lift following a better-than-expected Westpac Confidence Survey, and the pair is trying to build a floor from 0.7420 after slipping towards 0.7400 on trade headlines.

Australia’s West Consumer Confidence Survey printed at a healthy 3.9% after coming in at 0.3% in the previous period as consumers begin to allow themselves a glimmer of hope for Australia’s economic health looking forward. This was the best reading of the sentiment indicator since November of 2013, when the survey clipped in at 8.0%. As Westpac noted, “much of the improvement over the last year reflects a more balanced growth profile across states with stabilising conditions in the mining sector driving a recovery in Queensland and WA.”

Risk appetite is still in full-reverse mode after the US formally revealed that they plan to announce further tariffs on $200 billion USD worth of Chinese imports, and trade angst has returned to broader currency markets after a few days of relative calm after the US and China enacted round-turn tariffs on each other last Friday.

Early Wednesday still has Home Loans figures coming up shortly at 01:30 GMT, and a surprise positive reading could help spur Aussie traders to step back into the buy side.

AUD/USD Technical Analysis

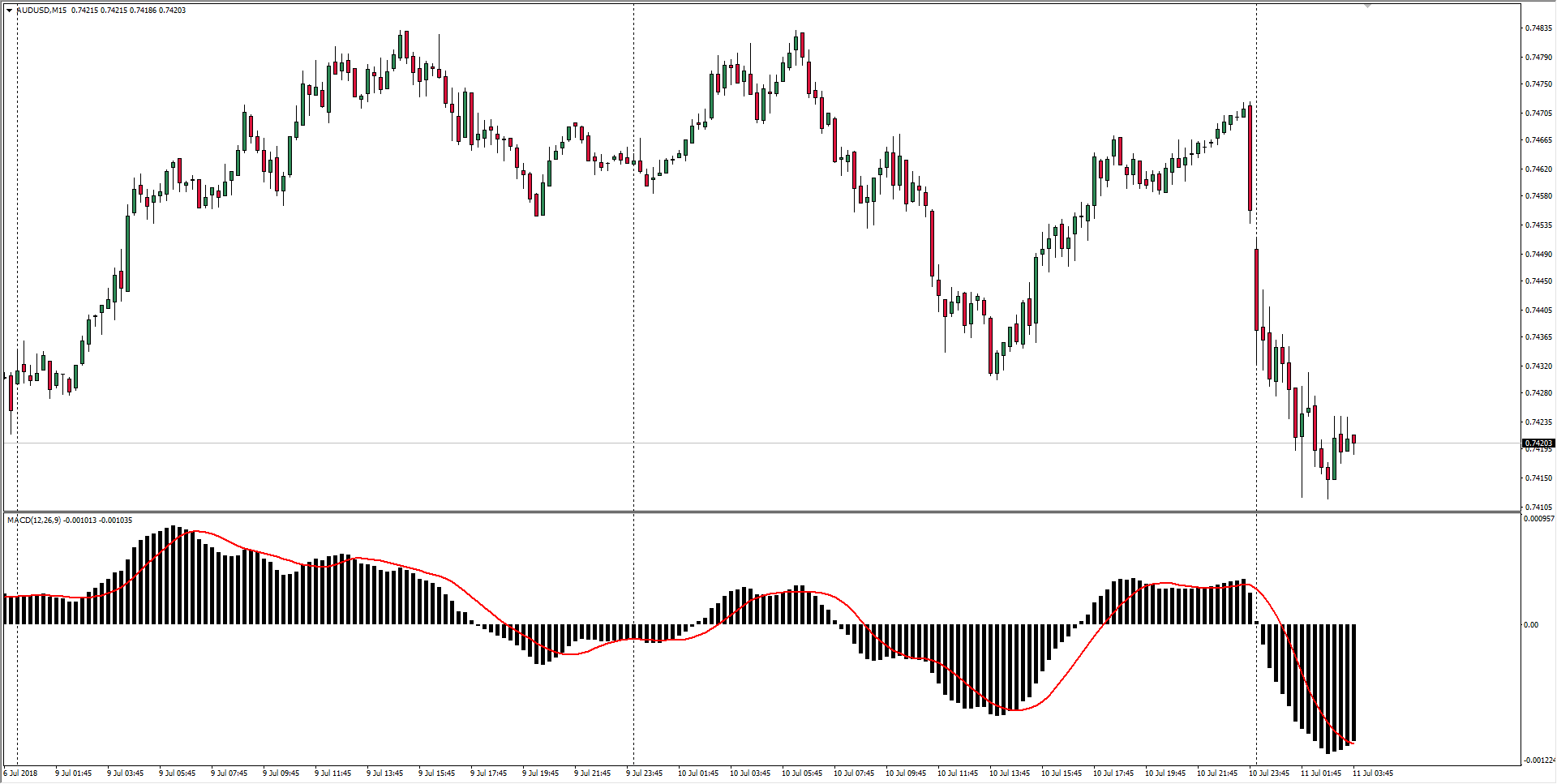

Aussie bulls made a second attempt to push for the 0.7500 key barrier recently, but momentum slowed prematurely and the announcement of more US-China tariffs to come has sent risk appetite reeling, cementing a softening position for the AUD. The 50- and 200-period MAs have also accelerated a bearish crossover on the lower timeframes, suggesting that bulls are likely to continue pulling back from their failure to capture 0.7500.

| Spot rate: | 0.7420 |

| Relative change: | -0.38% |

| High: | 0.7451 |

| Low: | 0.7411 |

| Trend: | Bearish |

| Support 1: | 0.7400 (Major technical level) |

| Support 2: | 0.7380 (June 26th low) |

| Support 3: | 0.7310 (current 2018 low) |

| Resistance 1: | 0.7485 (current week high; 200-period H4 SMA) |

| Resistance 2: | 0.7600 (major technical level) |

| Resistance 3: | 0.7674 (previous swing high) |

AUD/USD Chart, 15-minute