“¢ Disappointing Aussie data triggers the initial leg of the corrective slide.

“¢ A goodish pickup in the USD demand adds to the downward pressure.

“¢ Traders shrugged off mostly in line/hotter Chinese inflation figures.

The AUD/USD pair extended its steady decline through the early European session and has now eroded a major part of previous session’s up-move to 3-1/2 week tops.

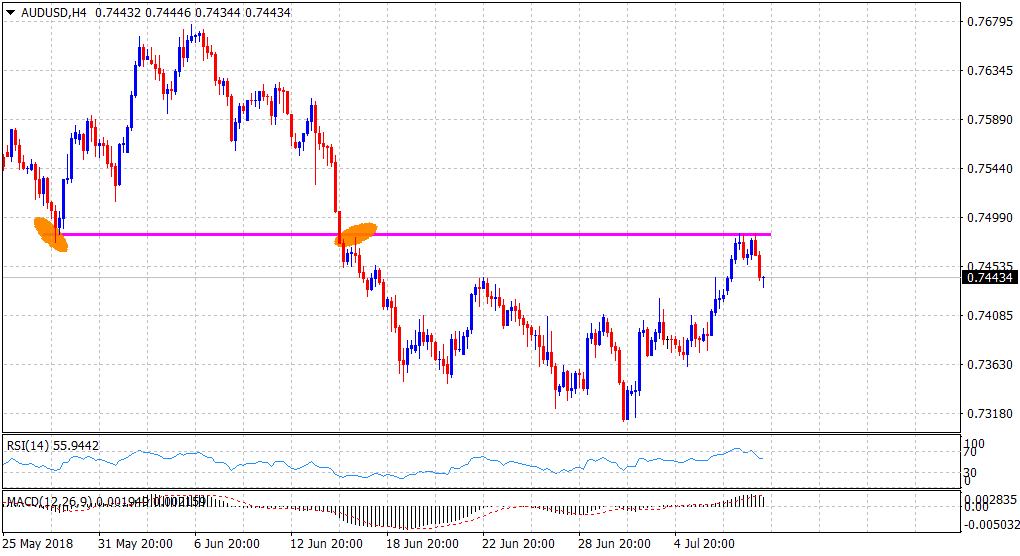

The pair stalled its recent recovery move from over two-year lows and struggled to make it through an important horizontal support now turned resistance, near the 0.7480-85 region. Today’s release of Australian NAB Business Confidence and Conditions surveys, which fell short of market expectations, triggered the initial leg of a corrective slide.

Adding to this, a goodish pickup in the US Dollar demand, coupled with negative trading sentiment around copper prices, which tends to undermine demand for the commodity-linked Australian Dollar, exerted some additional downward pressure and dragged the pair back below mid-0.7400s.

Meanwhile, the release of mostly in line/slightly hotter-than-expected Chinese inflation figures did little to provide any meaningful boost to the China-proxy Aussie, with the USD price dynamics turning out to be one of the key factors weighing on the major.

Technical Analysis

The pair now seems to have formed a bearish double-top chart pattern on the hourly chart, albeit short-term technical indicators have managed to hold in positive territory.

Hence, it would be prudent to wait for a follow-through weakness below the neckline support, near the 0.7420-10 region, before positioning for any further downfall.

Spot rate: 0.7443

Daily High: 0.7484

Daily Low: 0.7434

Trend: Turning bearish

Resistance

R1: 0.7465 (overnight daily closing level)

R2: 0.7484 (current day swing high)

R3: 0.7500 (psychological round figure mark)

Support

S1: 0.7419 (100-period SMA H1)

S2: 0.7402 (S2 daily pivot-point)

S3: 0.7361 (last Thursday swing low)