“¢ Optimism over US-China trade talks extends some support.

“¢ Positive copper prices remain supportive of the positive tone.

“¢ Further gains remained capped in wake of Lowe’s comments.

The AUD/USD pair caught some fresh bids on Friday, albeit struggled to make it through overnight swing high and has now retreated few pips from session tops.

Optimism over the US-China trade talks extended some support to the China-proxy extended some support to the China-proxy Australian Dollar. This coupled with an uptick in commodities, especially copper, further underpinned commodity-linked currencies, including the Aussie, and remained supportive of the pair’s modest recovery attempt from 20-month lows touched on Wednesday.

The uptick, however, lacked any strong conviction and remained capped below the 0.7300 handle, with the RBA Governor Philip Lowe‘s comments further collaborating towards keeping a lid on any meaningful up-move for the major.

Testifying before the House of Representatives’ Standing Committee on Economics, Lowe said that interest rates are to remain at record lows for a while yet and a lower exchange rate would do better for the Australian economy.

Currently trading around the 0.7270-65 region, traders now look forward to the release of Prelim UoM Consumer Sentiment index, the only highlight from today’s thin US economic docket, in order to grab some short-term opportunities on the last trading day of the week.

Technical Analysis

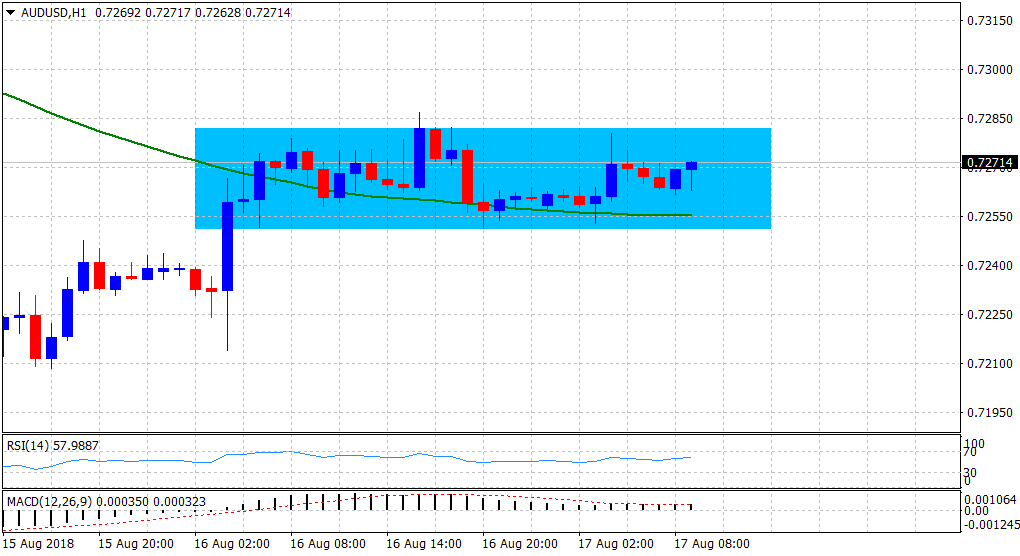

The pair now seems to have entered a consolidation phase and seems to have established a firm near-term base around the 100-hour SMA. With short-term technical indicators on the mentioned chart holding in bullish territory, a follow-through up-move, led by some fresh short-covering, now looks a distinct possibility.

Any meaningful up-move is likely to confront immediate resistance near the 0.7300 handle (weekly high), above which the recovery move could further get extended towards 0.7320 area (8-week old trading range support break-point) en-route 0.7345-50 supply zone.