“¢ Investors looked past today’s softer Australian consumer inflation figures.

“¢ Sliding US bond yields exert some fresh downward pressure on the USD.

The AUD/USD pair has managed to recover around 25-pips from session lows and is currently holding in neutral territory, above the 0.7400 handle.

The pair stalled softer Aussie consumer inflation data-led corrective slide from two-week tops and managed to catch some fresh bids at lower levels. A weaker tone surrounding the US Treasury bond yields kept the US Dollar bulls on the defensive and was seen as one of the key factors behind the pair’s modest rebound from session lows.

The uptick, however, lacked any strong conviction amid the prevalent cautious mood ahead of a crucial meeting between the US President Donald Trump and European Commission President Jean-Claude Juncker. Adding to this, subdued copper prices also did little to provide any additional boost to the commodity-linked Australian Dollar and further collaborated towards keeping a lid on the pair’s up-move.

With the USD price dynamics turning out to be an exclusive driver of the pair’s momentum, this week’s important US macro releases – durable goods orders and advance Q2 GDP growth figures, will play an important role in determining the pair’s next leg of directional move.

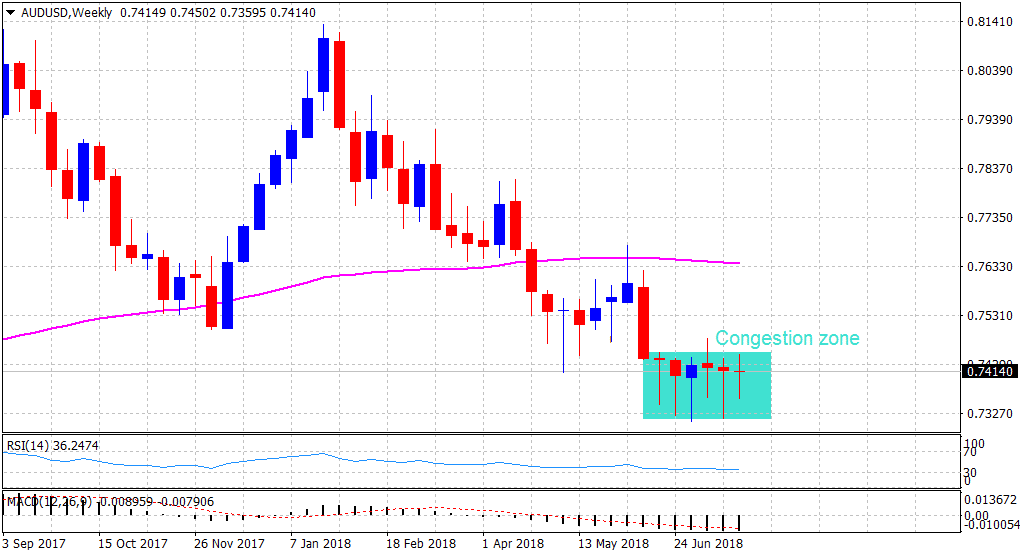

Technical Analysis

Looking at the technical picture, the pair remains within a broader trading range, held over the past six weeks or so, and has been facing difficulty in decisively breaking through the 0.7450 supply zone.

Mixed short-term technical indicators have also failed to support any firm directional bias and hence, it would be prudent to wait for a convincing move beyond the mentioned barrier before positioning for any further up-move.

Spot rate: 0.7414

Daily Low: 0.7392

Daily High: 0.7450

Trend: Sideways

Resistance

R1: 0.7450 (2-week tops set earlier today)

R2: 0.7474 (50-day SMA)

R3: 0.7500 (psychological round figure mark)

Support

S1: 0.7391 (100-period SMA H1)

S2: 0.7360 (overnight swing low)

S3: 0.7329 (S2 daily pivot-point)