- AUD/USD bears outplayed by the bulls, risk-on sentiment lives on.

- Technically, bulls cross the long term trendline, what now?

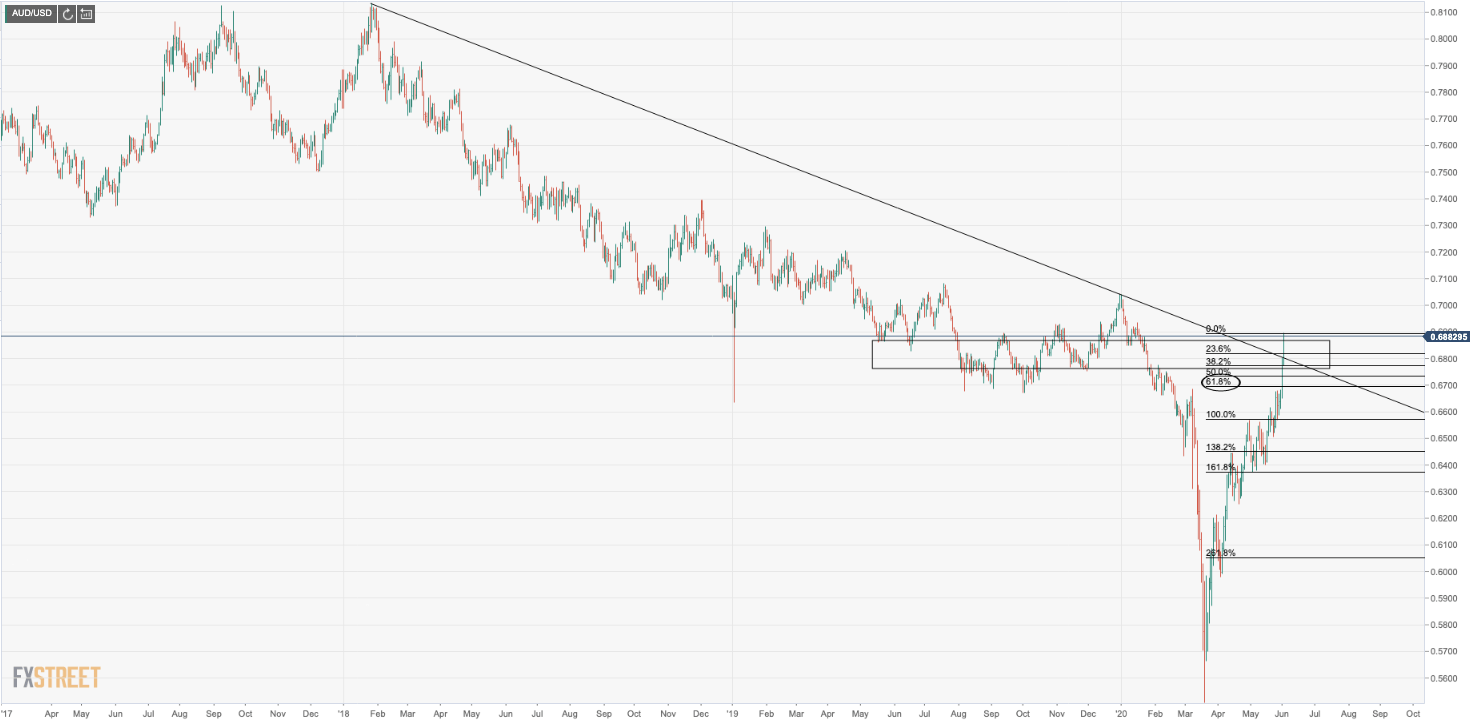

AUD/USD is trading at the highest levels since the start of 2020, eyeing the 0.69 handle having travelled from a low of 0.6774 to a high of 0.6895. Bulls have grabbed the market by their horns, tearing through what would have been tough resistance levels, especially given the fragile geopolitical backdrop.

The bulls have taken advantage of the bearish backdrop and punished committed bears, cleaning up their stale stops and that liquidity to push even higher. From a volume profile analysis, it makes perfect sense for AUD to be back to where prices had been agreed back in July and throughout H2 2019.

Risk sentiment has improved and equities have continued to prove resilient to a number of headwinds. US stocks have extended their pursuit of a 78.6% Fibonacci retracement, stunning those macro investors that have been banking on an outright global depression and subsequent financial markets crash.

The US dollar has been a major input to the rebound in FX and last week’s COT report showed that USD net longs moved lower breaking a nine-week trend. “This reflects the softer tone of the USD in the spot market which is a function of increased risk appetite,” analysts at Rabobank explained.

Bears outplayed

As mentioned the bulls have taken the bears to the cleaners. Bearish expectations have not played out, yet.

- Again, the global stock markets have rallied.

- We have not seen the market blink an eye at swells of fresh COVID-19 cases such as the 300 new asymptomatic carriers reported in Wuhan as the latest headline.

- The war of words between the US and China have not transpired into a fresh trade war or subsequent action such as new tariffs. The noise that China would break phase 1 rules related to USA purchase of agri’ has been subsequently debunked in the latest headlines. “Chinese firms continue to purchase US soybeans in line with market rules, unaffected by external factors. This is proven by Chinese firms’ buying of newly-harvested US soybeans on Mon, Zhang Xiaoping, country director for China at the US Soybean Export Council, told GT, ” the Global Times reported. Bloomberg also reported in an article, “American Exporters Sell Soy to China Despite Rising Tensions,” that ‘American soybean exporters sold several cargoes to Chinese state-run buyers, according to people familiar with the matter, showing that some transactions are still going through even after officials in Beijing ordered a pause in some purchases.’

RBA gives green light to bid up AUD further

The icing on the cake for AUD bulls was the blatant complacency by the Reserve bank of Australia which did not mention the strength of the Aussie which has rallied over 20% vs the USD since its recovery from the 2020 lows at 0.55c. This gave a green light for the bulls to hunt down the 0.70 level and push the barriers as the bears took to the sidelines or potentially reversed their bets.

As noted by analysts at ANZ Bank, the RBA gave an optimistic outlook and noted the improving global state of the pandemic:

Over the past month, infection rates have declined in many countries and there has been some easing of restrictions on activity. If this continues, a recovery in the global economy will get under way, supported by both the large fiscal packages and the significant easing in monetary policies.

Financial markets are more positive about the outlook and not just equities:

‘Globally, conditions in financial markets have continued to improve, although conditions in some markets remain fragile. Volatility has declined and credit markets have progressively opened to more firms,’ – RBA.

The Australian economy “is experiencing the biggest economic contraction since the 1930s”, but there are some encouraging signs:

It is possible that the depth of the downturn will be less than earlier expected. The rate of new infections has declined significantly and some restrictions have been eased earlier than was previously thought likely. And there are signs that hours worked stabilised in early May, after the earlier very sharp decline. There has also been a pick-up in some forms of consumer spending,’ – RBA.

Lastly, and most key, is that the RBA has largely chosen not to purchase bonds since the last meeting:

The government bond markets are operating effectively and the yield on 3-year Australian Government Securities (AGS) is at the target of around 25 basis points. Given these developments, the Bank has purchased government bonds on only one occasion since the previous Board meeting,’ – RBA.

So what now, stay bullish AUD?

That train may have already left the station and it could be a case of catching falling knives from this juncture.

While the bearish cases have not played out, it may only be a matter of time until they do. The threat of global depression is real and so too are the break downs in relations between the US and China.

Had it not been for the US riots, US President Donald Trump may have had more time to properly respond to the Hong Kong scenario as well as elaborate on China’s handling of COVID-19 and subsequent consequences. The China news conference has been shrugged off by markets, but it remains very much on Trump’s agenda and is not a closed book. For now, he needs to rescue his presidency.

The pandemic is likely to have long-lasting effects on the global economy and Australia’s – so, we are not out of the woods yet.

AUD/USD levels

The currency has returned to where markets agreed on prices for the whole of H2 2019. It is going to take a systemic shift in the markets for AUD to catch a bullish extension at this juncture. USD could well be ripe for an upside correction, as per the following analysis:

- DXY Price Analysis: Bulls looking left for structure, target prior lows, a 61.8% retracement

AUD/USD to test trendline support

Failures below the trend line, bears could target a 61.8% retracement of the prior impulse to the previous resistance structure. On the other hand, if the trend line holds, is blue skies from here for a new cyclical bull trend. The RBA could well be the best bet in town, especially if the `federal Reserve has no choice but to go harder to save its economy from collapse.