- Weak data from Australia’s largest customer and overbought RSI levels signal another pullback from important resistance.

- Multiple supports at the downside might challenge sellers.

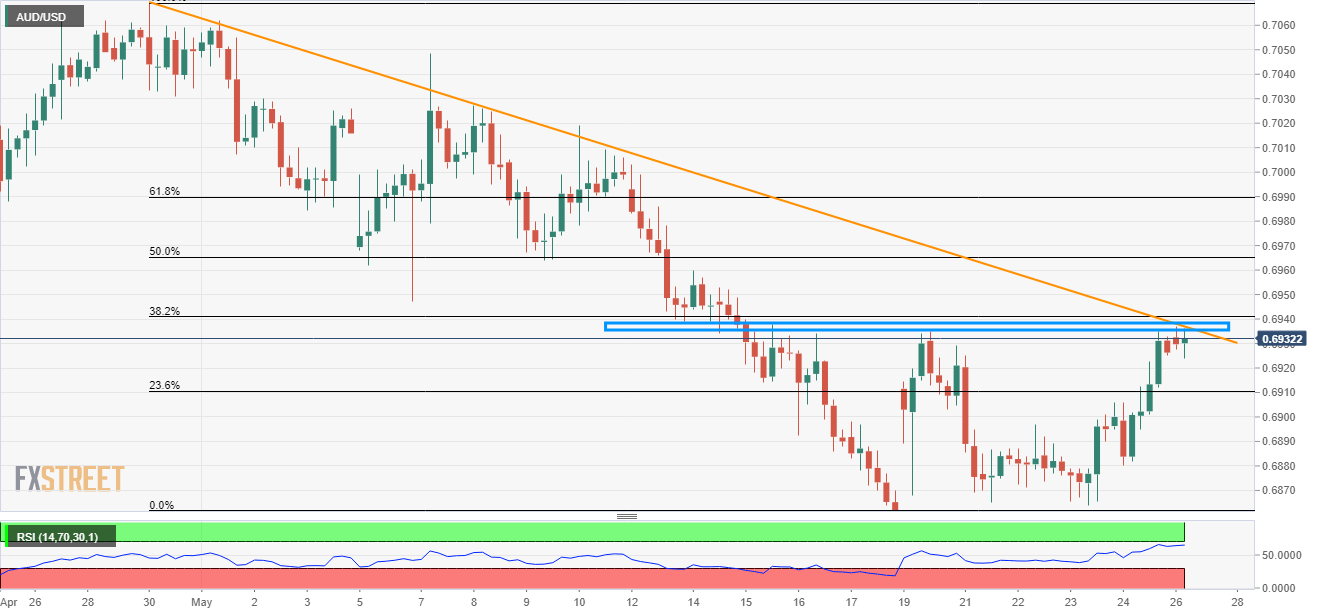

Given the technical reasons joining soft prints of China’s industrial profits, AUD/USD struggles around 0.6935/40 resistance-confluence during early Asian session this Monday.

Considering both the fundamentals and technical signals indicating pair’s another pullback from important resistance, 0.6900 and 0.6880 regains market attention.

Though, pair’s decline past-0.6880 can be challenged by 0.6860 if not then 2016 bottom near 0.6830 could play its role of support.

It should be noted that 14-bar relative strength index (RSI) is near to overbought region and indicates brighter chances of the quote’s pullback.

On the contrary, sustained break of 0.6935/40 region comprising a descending trend-line stretched from April 30 and a horizontal territory limiting the pair’s upside since mid-May can propel prices to 0.6970 and 0.7000 round-figure.

Also, pair’s extended rise past-0.7000 might not refrain from questioning 0.7030 and 0.7070 numbers to the north.

AUD/USD 4-Hour chart

Trend: Pullback expected