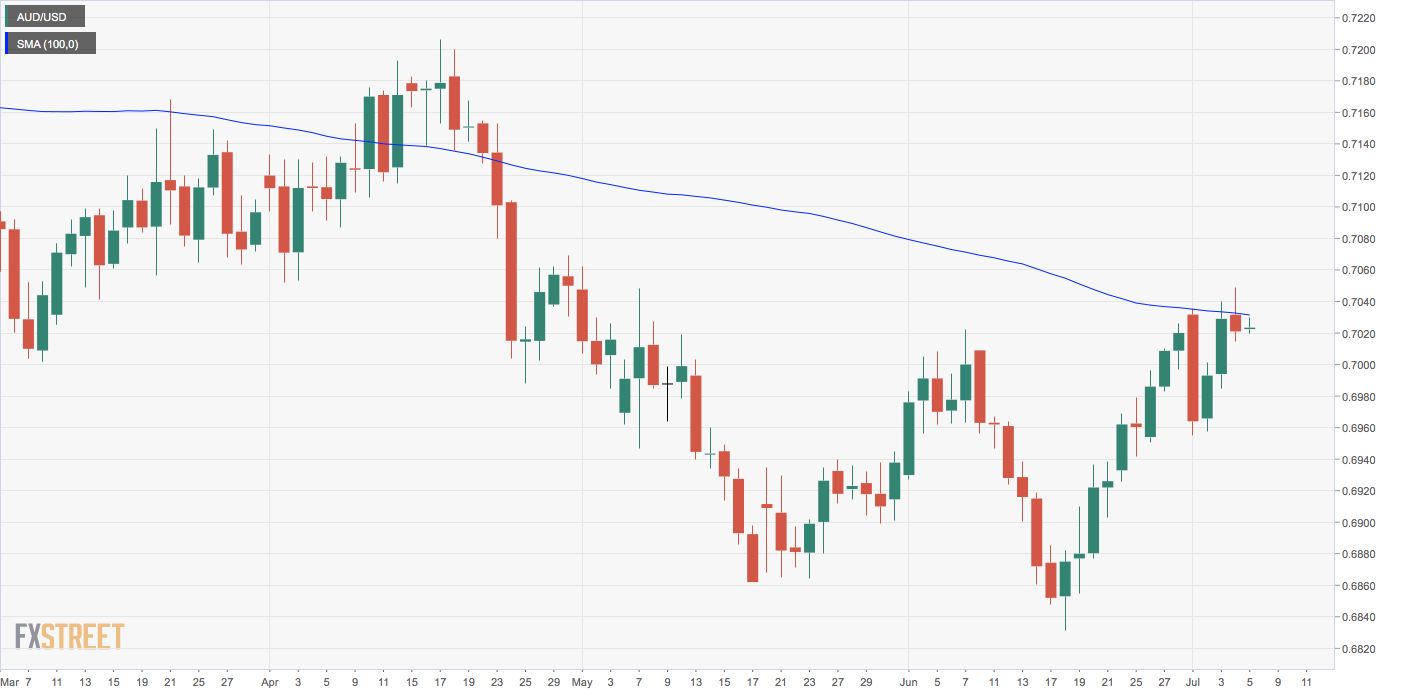

- AUD/USD tests 100-day MA hurdle.

- Thursday’s inverted hammer makes today’s close pivotal.

AUD/USD picked up a bid at lows below 0.7020 earlier today and but so far, the upside has been capped by the 100-day moving average (MA) at 0.7030.

The average has emerged as a strong resistance this week. For instance, the pair failed to take out the key hurdle in the Asian trading hours on Monday and closed the day with 0.83% losses.

Further, the pair failed to close above the average in the previous two trading days.

Notably, the pair created a bearish inverted hammer yesterday’s – an early sign of bearish reversal.

The trend change, however, would be confirmed if the spot closes today below the hammer candle’s low of 0.7015. A bearish close would mean the bounce from the June low of 0.6832 has ended and allow a drop to 0.6956 (July 2 low).

On the higher side, the hammer candle’s high of 0.7048 is the level to beat for the bulls. As of writing, the pair is trading at 0.7025.

Daily chart

Trend: Bearish below 0.7015

Pivot points